UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the RegistrantTx Filed by a Party other than the Registrant ¨o

Check the appropriate box:

|

| |

To | Preliminary Proxy Statement |

¨o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

¨x | Definitive Proxy Statement |

¨o | Definitive Additional Materials |

¨o | Soliciting Material Pursuant to §240.14a-12 |

JPMorgan Chase & Co.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | |

Tx | No fee required. |

¨o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which the transaction applies: |

| | (2) | Aggregate number of securities to which the transaction applies: |

| | (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | (4) | Proposed maximum aggregate value of the transaction: |

| | (5) | Total fee paid: |

¨o | Fee paid previously with preliminary materials. |

¨o

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

JPMorgan Chase & Co.

270 Park Avenue

New York, New York 10017-2070

April __, 20138, 2015

Dear fellow shareholders:

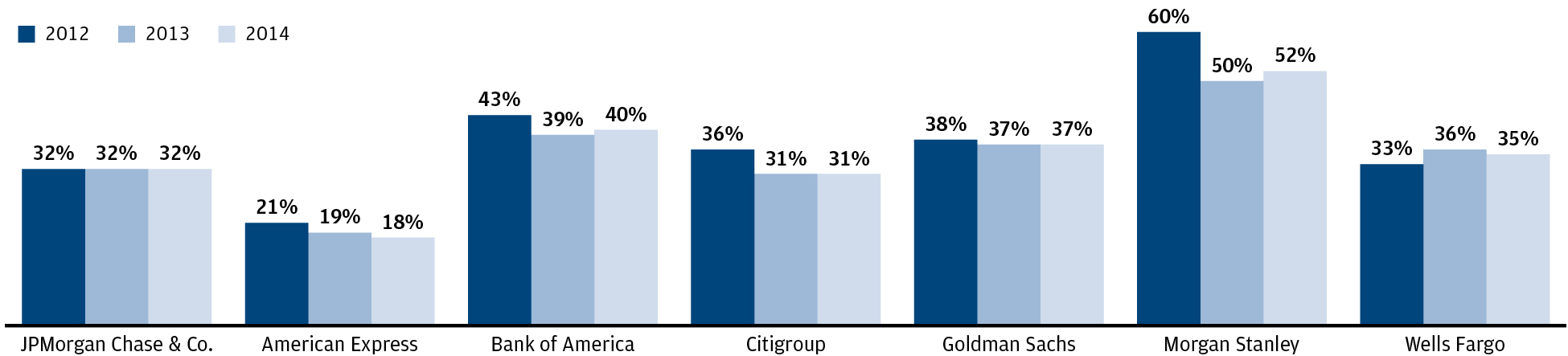

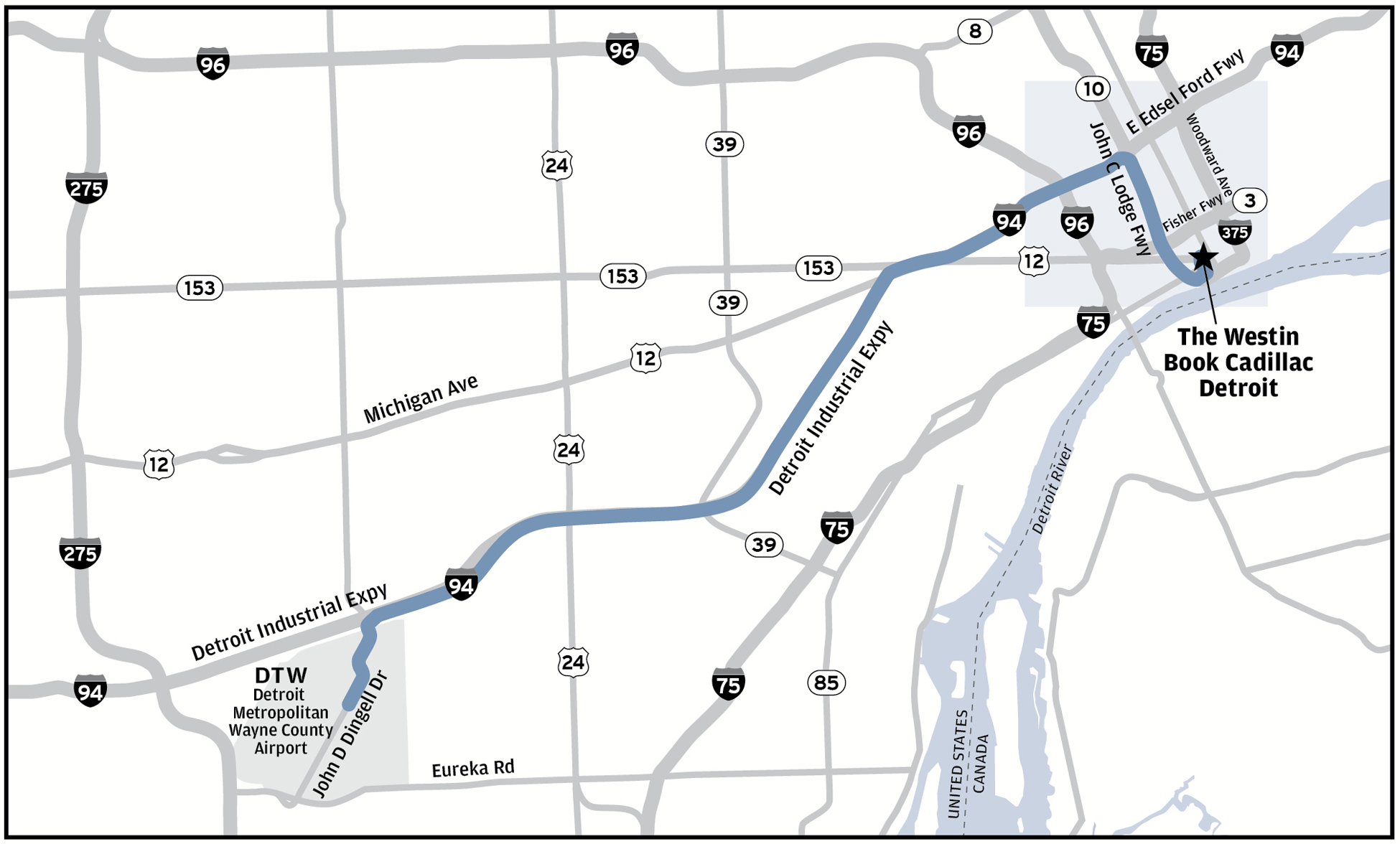

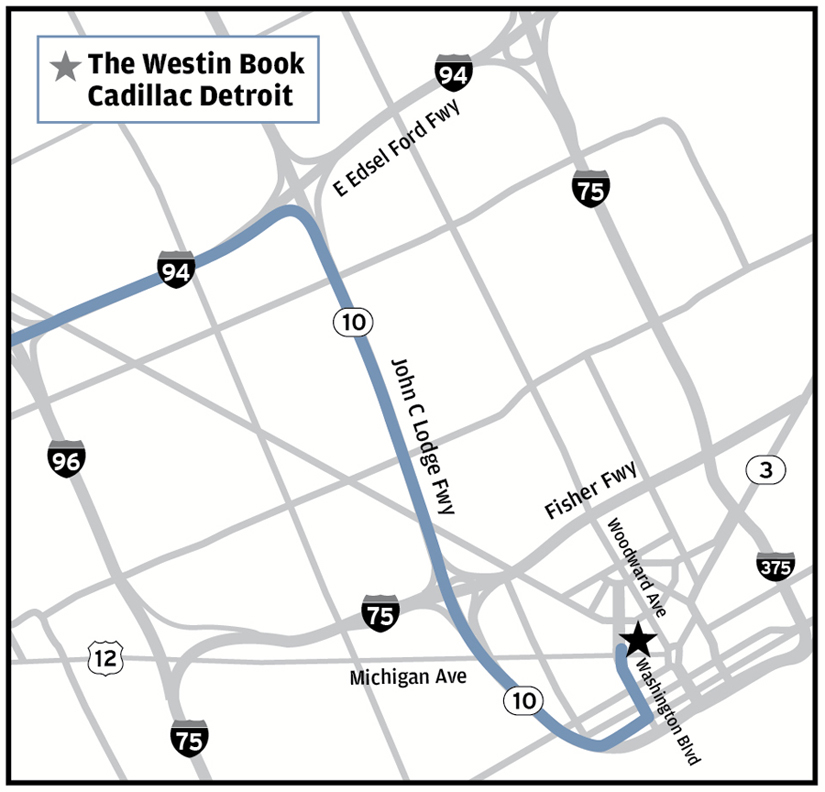

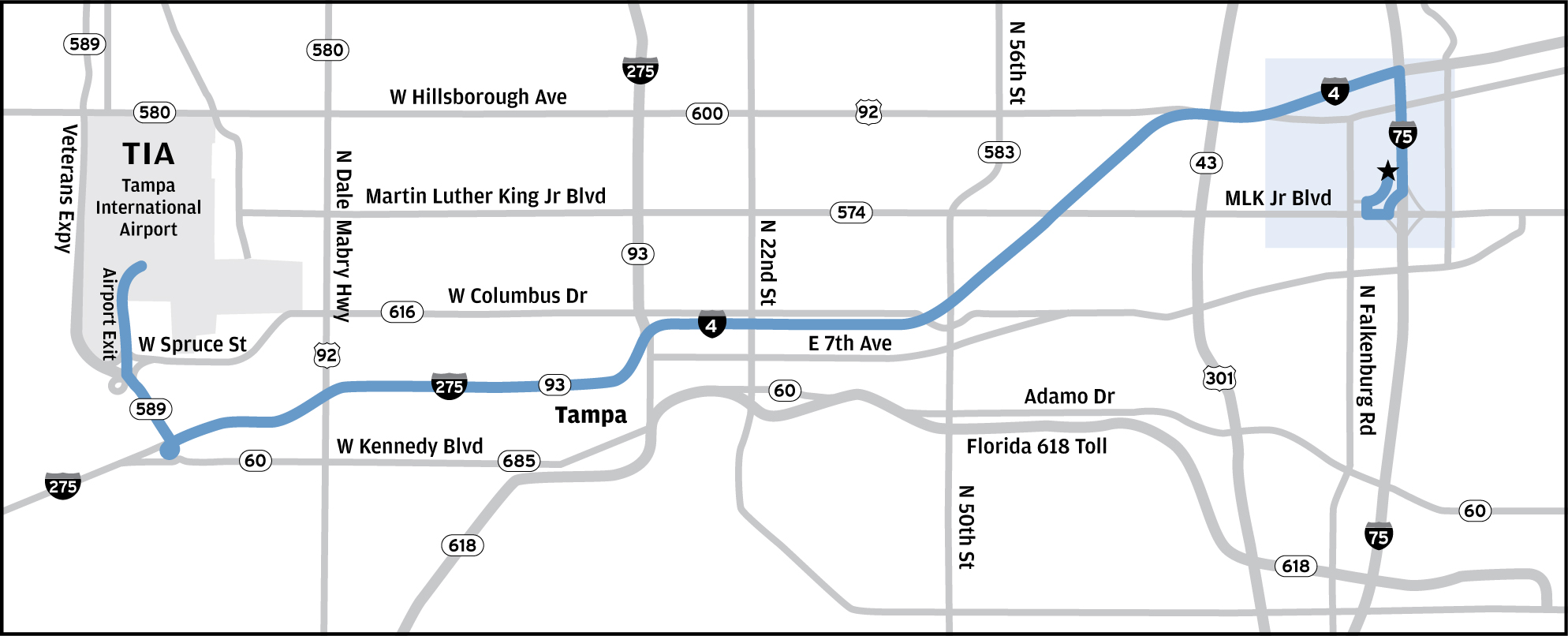

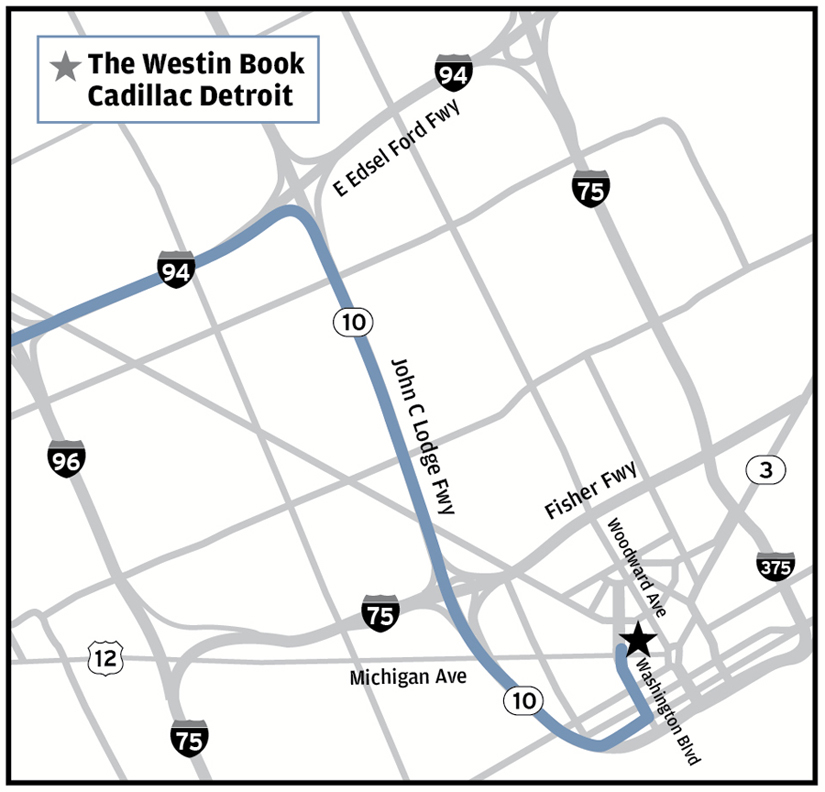

We are pleased to invite you to the annual meeting of shareholders to be held on May 21, 201319, 2015, at our Highland Oaks CampusThe Westin Book Cadillac Detroit in Tampa, Florida.Detroit, Michigan. As we have done in the past, in addition to considering the matters described in the proxy statement, we will review major developments since our last shareholders’ meeting.provide an update on the Firm’s activities and performance.

We hope that you will attend the meeting in person. We strongly encourage you to designate the proxies named on the proxy card to vote your shares even if you are planning to come. This will ensure that your common stock is represented at the meeting.

The proxy statement explains more about proxy voting. Please read it carefully. We look forward to your participation.

Sincerely,

James Dimon

Chairman and Chief Executive Officer

Notice of 20132015 Annual Meeting

of Shareholders and Proxy Statement

|

| | | |

| DATE | | Tuesday, May 19, 2015 |

| TIME | | 10:00 a.m. Eastern Daylight Time |

| PLACE | | Westin Book Cadillac Detroit 1114 Washington Boulevard Detroit, Michigan 48226 |

| | | |

Date: | | Tuesday, May 21, 2013 |

Time: | | 10:00 am |

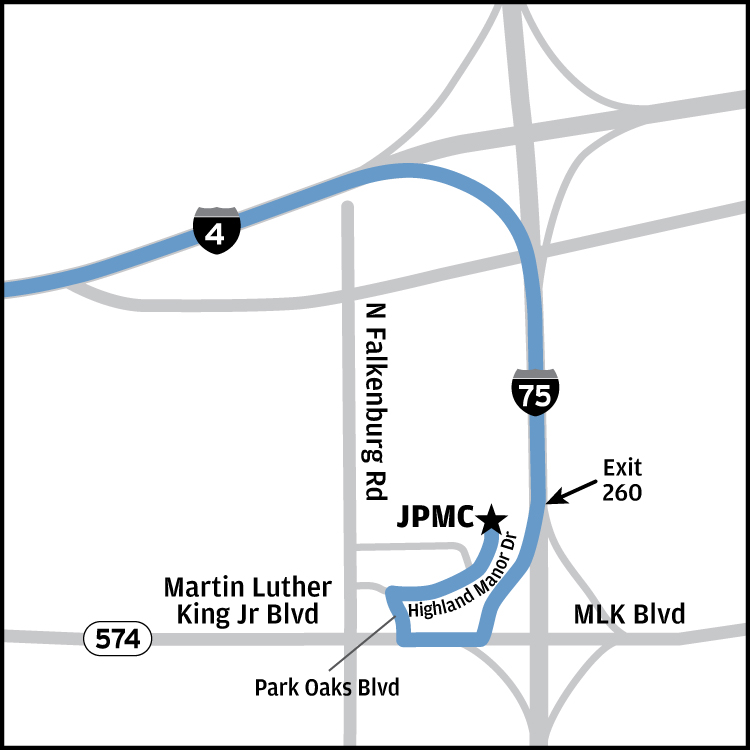

Place:MATTERS TO BE | | JPMorgan Chase Highland Oaks Campusl Election of directors

|

| VOTED ON | | l Advisory resolution to approve executive compensation |

| | l Ratification of PricewaterhouseCoopers LLP as our independent registered public 10420 Highland Manor Drive, Building 2 accounting firm for 2015

|

| | Tampa, FL 33610l Approval of Amendment to Long-Term Incentive Plan

|

| |

l Shareholder proposals, if they are introduced at the meeting

|

| | l Any other matters that may properly be brought before the meeting |

| | |

| | By order of the Board of Directors |

| | | |

| | Anthony J. Horan |

| | Secretary |

| | | |

| | April 8, 2015 |

Matters to be voted on:

Election of directors

Ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2013

Advisory resolution to approve executive compensation

Amendment to the Firm’s Restated Certificate of Incorporation to authorize shareholder action by written consent

Reapproval of the Key Executive Performance Plan

Shareholder proposals, if they are introduced at the meeting

Any other matters that may properly be brought before the meeting

By order of the Board of Directors

Anthony J. Horan

Secretary

Please vote promptly.

If you hold your shares in street name and do not provide voting instructions, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote. See “How votes are counted” aton page 52.97 of this proxy statement.

We sent shareholders of record at the close of business on March 22, 2013,20, 2015, a Proxy Statement, together with an accompanying form of proxy card and Annual Report, or a Notice of Internet Availability of Proxy Materials (“Notice”) on or about April __, 2013.8, 2015.

Our 2015 Proxy Statement and Annual Report for the year ended December 31, 2014, are available free of charge on our website at investor.shareholder.com/jpmorganchase/annual.cfm. Instructions on how to receive a printed copy of our proxy materials are included in the notice,Notice, as well as in this attached Proxy Statement.

Our 2013 Proxy Statement and Annual Report for the year ended December 31, 2012, are available free of charge on our Website at http://investor.shareholder.com/jpmorganchase/annual.cfm.

If you plan to attend the meeting in person, you will be required to present a valid form of government-issued photo identification, such as a valid driver’s license or passport, and proof of ownership of our common stock as of our record date March 22, 2013.20, 2015. See “Attending the annual meeting” aton page 53.98 of this proxy statement.

|

| | |

Contents | | Page |

| | |

Proposal 1: | | |

| | | | |

| |

| | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | |

| | |

| |

| |

| |

| |

| |

| |

| | | | |

| |

Advisory resolution to approve executive officerscompensation | |

| |

| | |

| | |

| | |

| |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| | | |

| PROPOSAL 2 (continued): | |

| |

| | |

| | |

| |

Proposal 2: | | |

Proposal 3: | | |

Proposal 4: | | |

Proposal 5: | | |

Proposals 6-9: | |

| | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | |

| |

Appendix A: | | | |

| | |

Appendix C: | | |

Appendix D: | | |

Appendix E: | | |

Appendix F: | | | |

| | |

| | | |

| |

20132015 Proxy Summarysummary

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all the information you should consider, and you should read the entire proxy statement carefully before voting.

|

| |

Annual Meeting of Shareholders |

Time and Date: | 10:00 am Eastern Daylight Time, May 21, 2013

|

Place: | JPMorgan Chase Highland Oaks Campus

10420 Highland Manor Drive, Building 2

Tampa, Florida 33610

|

|

|

Record Date: | March 22, 2013 |

Voting and Attendance at Meeting | Shareholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote on each matter to be voted on. Voting may be done over the Internet, by telephone, by completing and mailing the proxy card, or in person at the annual meeting. Additional information is provided under “General information about the meeting” at page 52.

If you plan to attend the meeting in person, you will be required to present a valid form of government-issued photo identification, such as a driver’s license, and proof of ownership as of our record date March 22, 2013. See “Attending the annual meeting” at page 53.

|

|

| | | | | | | | |

| Matters to be Voted on: | | | |

| Management Proposals | | | | | | | |

| The Board of Directors recommends you vote For each director nominee and for the following proposals (for more information see page referenced):

| |

| 1. Election of Directors | | | | 4. Amendment to Certificate of Incorporation authorizing shareholder action by written consent | | | |

| | | | | | | | |

| 2. Ratification of PricewaterhouseCoopers LLP as the Firm’s independent registered public accounting firm | | | | 5. Reapproval of the Key Executive Performance Plan | | | |

| | | | | | | | |

| 3. Advisory resolution to approve executive compensation

| | | | | |

| |

| | | | | | | | |

| | | | | | | | |

| Shareholder Proposals (if they are introduced at the meeting)

| |

| The Board of Directors recommends you vote Against each of the following shareholder proposals (for more information see page referenced):

| |

| 6. Require separation of chairman and CEO

| | | | 8. Adopt procedures to avoid holding or recommending investments that contribute to human rights violations | | | |

| | | | | | | | |

| 7. Require executives to retain significant stock until reaching normal retirement age | | | | 9. Disclose Firm payments used directly or indirectly for lobbying, including specific amounts and recipients’ names | | | |

| | | | | | | | |

|

| |

JPMorgan Chase & Co./ 2013 Proxy Statement | i |

|

| | |

Election of Directors |

The Board has nominated 11 directors: the CEO and 10 other serving directors, all of whom are independent. |

Nominee and Principal Occupation | | Nominee and Principal Occupation |

James A. Bell

Retired Executive Vice President of The Boeing Company

Director since 2011

| | Timothy P. Flynn

Retired Chairman of KPMG International

Director since May 2012

|

| | |

Crandall C. Bowles

Chairman of Springs Industries, Inc.

Director since 2006

| | Ellen V. Futter

President and Trustee of the American Museum of Natural History

Director since 2001 and Director of J.P. Morgan & Co. Incorporated from 1997 to 2000

|

| | |

Stephen B. Burke

Chief Executive Officer of NBCUniversal, LLC and Executive Vice President of Comcast Corporation

Director since 2004 and Director of Bank One Corporation from 2003 to 2004

| | Laban P. Jackson, Jr.

Chairman and Chief Executive Officer of Clear Creek Properties, Inc.

Director since 2004 and Director of Bank One Corporation from 1993 to 2004

|

| | |

David M. Cote

Chairman and Chief Executive Officer of Honeywell International Inc.

Director since 2007

| | Lee R. Raymond (Presiding Director)

Retired Chairman and Chief Executive Officer of Exxon Mobil Corporation

Director since 2001 and Director of J.P. Morgan & Co. Incorporated from 1987 to 2000

|

| | |

James S. Crown

President of Henry Crown and Company

Director since 2004 and Director of Bank One Corporation from 1991 to 2004

| | William C. Weldon

Retired Chairman and Chief Executive Officer of Johnson & Johnson

Director since 2005

|

| | |

James Dimon

Chairman and Chief Executive Officer of

JPMorgan Chase & Co.

Director since 2004 and Chairman of the Board of Bank One Corporation from 2000 to 2004

| |

|

Corporate Governance

The Board strongly endorses the continued role of Jamie Dimon as both Chairman and CEO under the Board oversight structure led by our Presiding Director. The Firm has had strong performance through the cycle since Mr. Dimon became Chairman and CEO, and during a time when many other financial institutions with independent Chairs experienced great difficulty. The strength and independence of the Board’s oversight has been well demonstrated by the actions taken and in process following the events that developed in the Chief Investment Office in 2012.

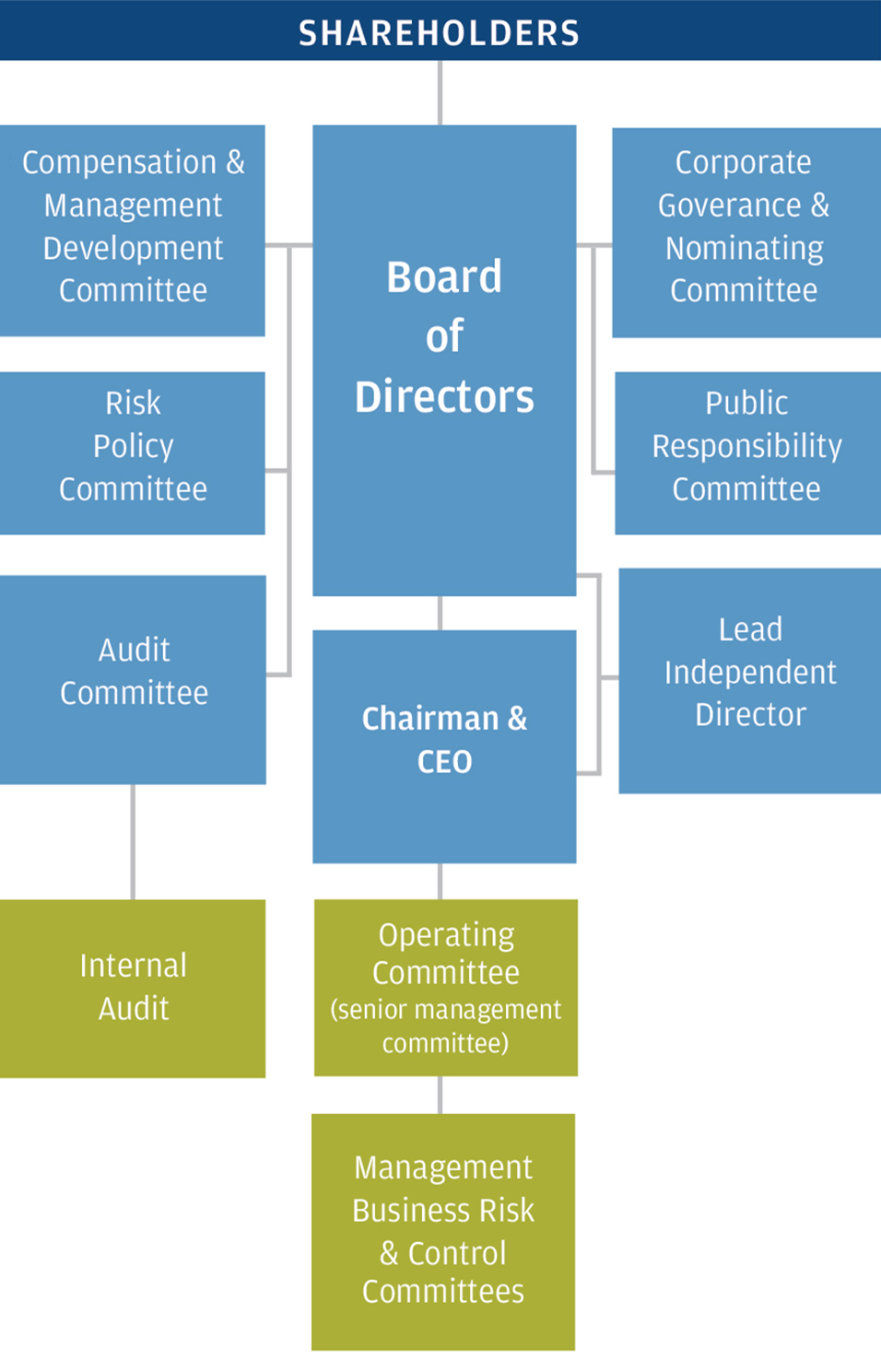

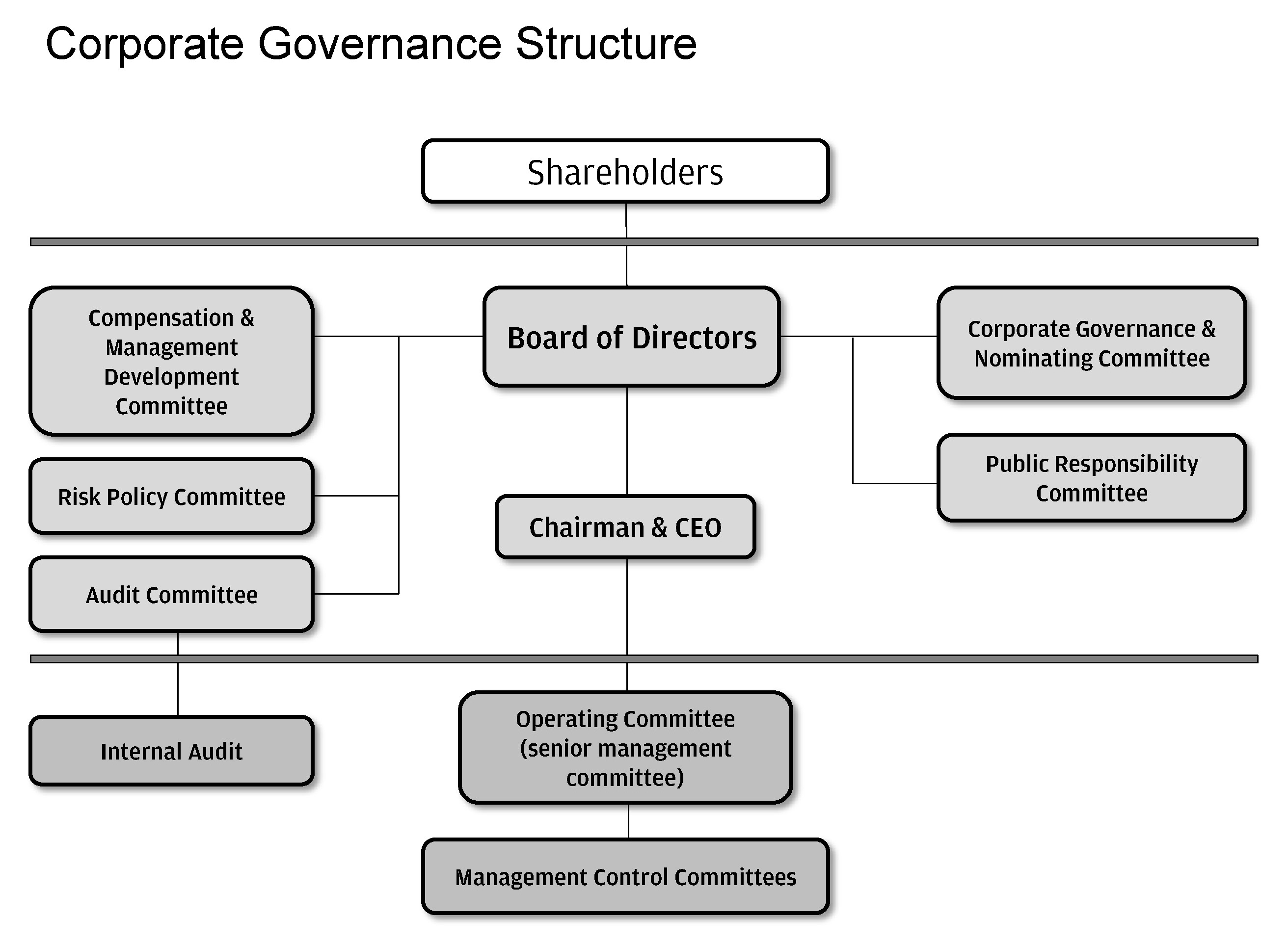

Corporate governance is a continuing focus at JPMorgan Chase, starting with our Board of Directors and extending throughout the Firm.

Independence: Every director other than the CEO (who serves as Chairman) is independent, and independent directors comprise 100% of the following principal Board committees.

|

| | | | |

Audit Committee | | Public Responsibility Committee |

Compensation & Management Committee | | Risk Policy Committee |

Corporate Governance & Nominating Committee | | |

Presiding Director: The Firm’s Presiding Director is appointed annually by and from among the independent directors, approves Board meeting agendas and schedules, may add agenda items, approves Board meeting materials for distribution to the Board, facilitates communication between the Chairman and CEO and the

|

| |

ii | JPMorgan Chase & Co./ 2013 Proxy Statement |

independent directors, as appropriate, and is available for consultation and communication with major shareholders where appropriate.

Executive sessions: Independent directors generally meet in executive session as part of each regularly scheduled Board meeting, with discussion led by the Presiding Director.

Strong committee structure: All chairs of principal committees are independent, approve agendas and material for meetings and work directly with senior management responsible for matters within the scope of their responsibilities.

Resources: The Board has complete access to management and the Board and Board Committees can, if they wish to do so, seek legal or other expert advice from sources independent of management.

Share retention: For so long as they serve, the directors pledge they will retain all shares of the Firm’s common stock purchased on the open market or received pursuant to their service as a Board member.

Majority voting: Directors are elected annually (there is not a “staggered” board), with majority voting in uncontested elections.

Shareholder rights: Shareholders holding at least 20% of the outstanding shares of common stock (net of hedges) can call a special meeting. The Board is proposing for shareholder approval an amendment to the Firm’s Certificate of Incorporation that would permit shareholders to act by written consent on terms intended to be substantially similar to the terms applicable to call special meetings.

Additional information is provided under Corporate governance at page 7 and in response to Proposal 6 to require separation of Chairman and CEO.

Compensation Principles and 2012 Executive Compensation

Compensation determinations are guided by the JPMorgan Chase Compensation Principles and Practices. As described starting at page 18 and in Appendix C at page 59, these principles include:

Maintaining strong governance: Independent Board oversight of the Firm’s compensation principles and practices and their implementation

Attracting and retaining top talent: A recognition that competitive and reasonable compensation helps attract and retain the high quality people necessary to grow and sustain our businesses

Tying compensation to performance:

| |

◦ | A focus on the qualitative as well as the quantitative performance of the individual employee, the relevant line of business or function and the Firm as a whole |

| |

◦ | A focus on multi-year, long-term, risk-adjusted performance and rewarding behavior that generates sustained value for the Firm through business cycles |

| |

◦ | Performance assessments that are broad-based and balanced, including an emphasis on teamwork and a “shared success” culture |

Aligning with shareholder interests:

| |

◦ | A significant stock component (with deferred vesting) for shareholder alignment and retention of top talent |

| |

◦ | Very strict limits or prohibitions on executive perquisites, special executive retirement severance plans, and no golden parachutes |

Integrating risk and compensation:

| |

◦ | Input into compensation determinations by risk and control functions |

| |

◦ | Although awards are made with the expectation that they will vest in accordance with their terms, all awards contain strong recovery provisions, and additional risk-related recovery provisions apply to the Operating Committee, the Firm’s most senior management group, and to a group of senior employees we refer to as Tier 1 employees with primary responsibility for risk positions and risk management |

| |

◦ | Shares received by Operating Committee members are subject to robust retention requirements and a prohibition on hedging |

|

| |

JPMorgan Chase & Co./ 2013 Proxy Statement | iii |

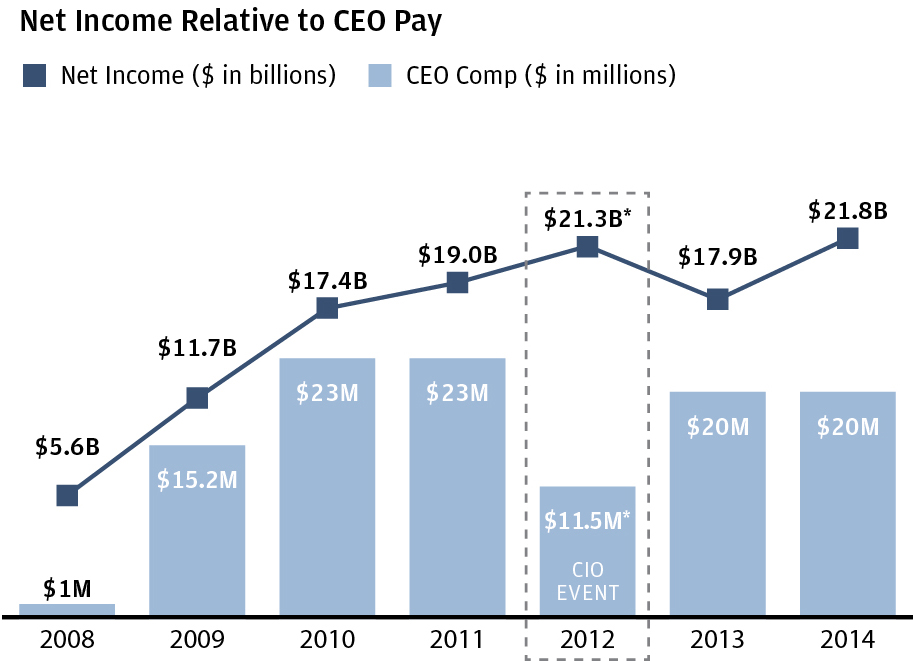

2012 Performance Highlights of the Firm 1

During 2012, the Firm continued its strong performance, as reflected in:

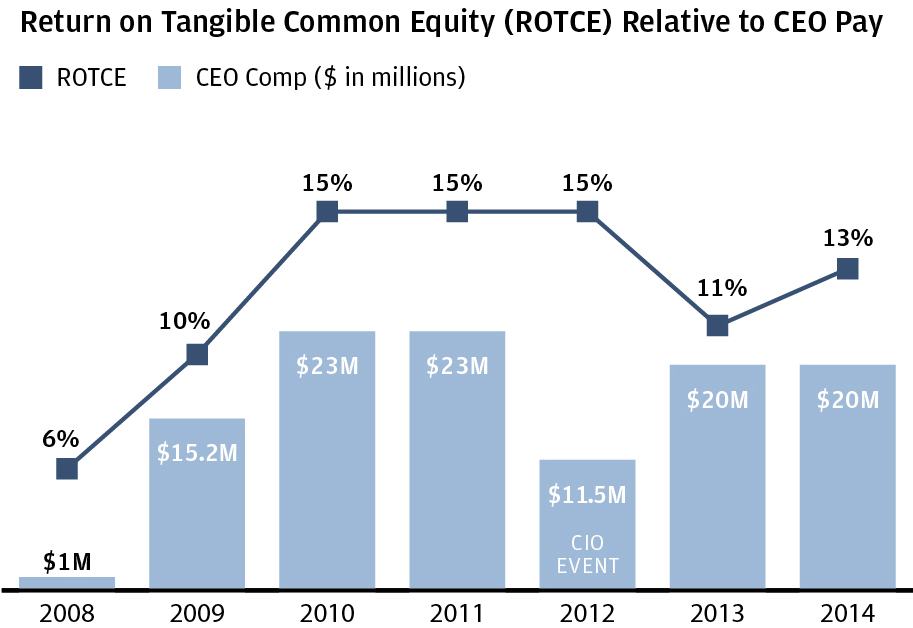

Third consecutive year of record net earnings and 15% ROTCE; ROE of 11%

Record net earnings of $21.3 billion, up 12%; Record EPS of $5.20 per share, up 16%

Common share price increased by 32% in 2012; total return with dividends of 36%

Basel I Tier I Common ratio of 11.0% and Tier 1 Capital ratio of 12.6% at year end

Provided credit and raised capital of over $1.8 trillion for its commercial and consumer clients, including $20 billion of credit provided to U.S. small businesses, up 18% over the prior year

Remained committed to helping homeowners and preventing foreclosures

Continued growth of the franchise, and substantial investment in the future

The foregoing results include the effect of significant losses incurred in 2012 in the Synthetic Credit Portfolio within the Firm’s Chief Investment Office. For more information about the Firm’s 2012 performance, see pages 16–17 and Appendix E at page 62.

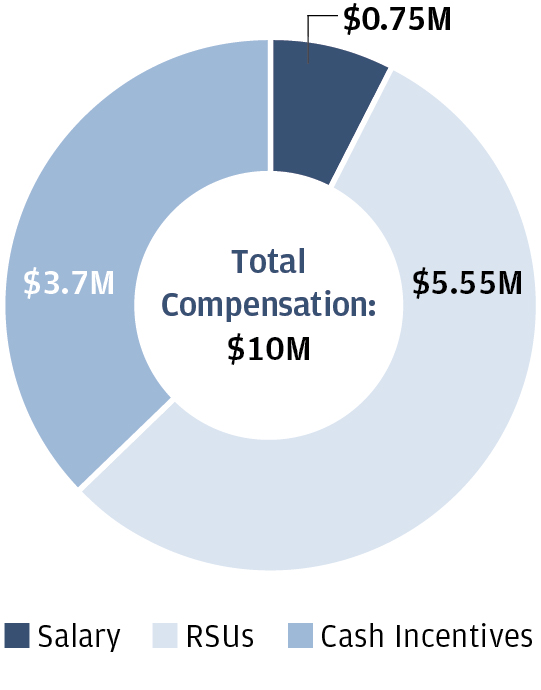

2012 Compensation for Mr. Dimon: As announced on January 16, 2013, the Board approved 2012 compensation for Mr. Dimon in the amount of $11.5 million, down 50% from the prior year. Compensation included salary of $1.5 million (flat with the prior year) and incentive compensation of $10 million, all in the form of RSUs (down 53.5% from the prior year). The RSUs vest over three years, half after two years and the other half after three years. The Board also deferred, for a period up to July 22, 2014, vesting of options in the form of share settled stock appreciation rights it had granted Mr. Dimon in January 2008 and which had been scheduled to vest in January 2013.

_______________________

| |

1 | For notes on non-GAAP and other financial measures, including managed basis reporting relating to the Firm’s business segments, see Appendix E at page 68.

|

2012 Compensation for Named Executive Officers

The following table shows annual salary paid and incentive compensation awarded with respect to 2012 for the Named Executive Officers. This table differs from the Summary Compensation Table required by the SEC at page 30, and is not a substitute for such information. For more information about the Firm’s compensation of its Named Executive Officers, see the Compensation Discussion and Analysis at page 16, and Appendix D at page 61.

|

| | | | | | | | | | | | | | | | | | | | |

| 2012 Salary and incentive compensation | Annual compensation |

| | | Salary ($) |

| | Incentive compensation | | |

| Name and principal position | | Cash ($) |

| | RSUs ($) |

| | SARs ($) |

| | Total ($) |

|

| James Dimon | | $ | 1,500,000 |

| | $ | 0 |

| | $ | 10,000,000 |

| | $ | 0 |

| | $ | 11,500,000 |

|

| Chairman and CEO | | | | | | | | | |

|

|

| | | | | | | | | | |

|

|

| Douglas L. Braunstein | | 750,000 |

| | 2,125,000 |

| | 2,125,000 |

| | 0 |

| | 5,000,000 |

|

| Vice Chairman (Former CFO) | | | | | | | | | |

|

|

| | | | | | | | | |

|

| Mary Callahan Erdoes | | 750,000 |

| | 4,900,000 |

| | 7,350,000 |

| | 2,000,000 |

| | 15,000,000 |

|

| CEO Asset Management | | | | | | | | | |

|

|

| | | | | | | | | | |

|

|

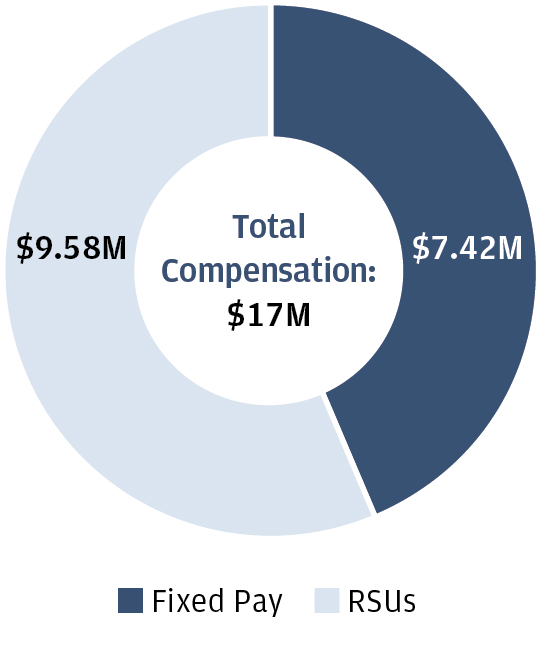

Daniel E. Pinto 1 | | 750,000 |

| | 8,125,000 |

| | 7,125,000 |

| | 1,000,000 |

| | 17,000,000 |

|

| Co-CEO Corporate & Investment Bank | | | | | | | | | | |

| | | | | | | | | | | |

| Matthew E. Zames | | 750,000 |

| | 6,100,000 |

| | 9,150,000 |

| | 1,000,000 |

| | 17,000,000 |

|

| Co-Chief Operating Officer | | | | | | | | | | |

1 For Mr. Pinto, the terms and composition of compensation are structured to reflect applicable United Kingdom standards as described at page 23.

|

| |

iv | JPMorgan Chase & Co./ 2013 Proxy Statement |

Proxy statement

Your vote is very important. For this reason, theThe Board of Directors of JPMorgan Chase & Co. (“JPMorgan Chase” or the “Firm”) is requesting that you allow your common stock to be represented at the annual meeting by the proxies named on the proxy card. This proxy statement is being

sent or made available to you in connection with this request and has been prepared for the Board by our management. TheThis proxy statement is being sent and made available to our shareholders on or about April __, 2013.8, 2015.

Annual meeting overview

|

| |

| MANAGEMENT PROPOSALS | |

The Board of Directors recommends you vote FOR each director nominee and FOR the following proposals (for more information see page referenced): |

| |

| 1. Election of directors | |

| |

| 2. Advisory resolution to approve executive compensation | |

| |

| 3. Ratification of PricewaterhouseCoopers LLP as the Firm’s independent registered public accounting firm | |

| |

| 4. Approval of Amendment to Long-Term Incentive Plan | |

| |

| |

SHAREHOLDER PROPOSALS (if they are introduced at the meeting) |

|

The Board of Directors recommends you vote AGAINST each of the following shareholder proposals (for more information see page referenced): |

| |

| |

| 5. Independent board chairman — require an independent Chair | |

| |

| 6. Lobbying — report on policies, procedures and expenditures | |

| |

| 7. Special shareowner meetings — reduce ownership threshold from 20% to 10% | |

| |

| 8. How votes are counted — count votes using only for and against | |

| |

| 9. Accelerated vesting provisions — report names of senior executives and value of equity awards that would vest if they resign to enter government service | |

| |

| 10. Clawback disclosure policy — disclose whether the Firm recouped any incentive compensation from senior executives | |

| |

|

| |

JPMORGAN CHASE & CO. • 2015 PROXY STATEMENT • 1 |

The Board of Directors has nominated the 11 individuals listed below as directors; if elected by shareholders at our annual meeting, they will be expected to serve until next year’s annual meeting. All of the nominees are currently serving as directors.

|

| | | | | | | | |

| The Board has nominated 11 directors: the 10 independent directors and the CEO |

| | | | | | | | | |

| NOMINEE | | AGE | | PRINCIPAL OCCUPATION | | DIRECTOR SINCE | | COMMITTEE MEMBERSHIP 1 |

| Linda B. Bammann | | 59 | | Retired Deputy Head of Risk Management of JPMorgan Chase & Co.2 | | 2013 | | Public Responsibility; Risk Policy |

| James A. Bell | | 66 | | Retired Executive Vice President of The Boeing Company | | 2011 | | Audit |

| Crandall C. Bowles | | 67 | | Chairman of The Springs Company | | 2006 | | Audit; Public Responsibility (Chair) |

| Stephen B. Burke | | 56 | | Chief Executive Officer of NBCUniversal, LLC | | 2004 Director of Bank One Corporation from 2003 to 2004 | | Compensation & Management Development; Corporate Governance & Nominating |

| James S. Crown | | 61 | | President of Henry Crown and Company | | 2004 Director of Bank One Corporation from 1991 to 2004 | | Risk Policy (Chair) |

| James Dimon | | 59 | | Chairman and Chief Executive Officer of JPMorgan Chase & Co.

| | 2004 Chairman of the Board of Bank One Corporation from 2000 to 2004 | | |

| Timothy P. Flynn | | 58 | | Retired Chairman and Chief Executive Officer of KPMG | | 2012 | | Public Responsibility; Risk Policy |

| Laban P. Jackson, Jr. | | 72 | | Chairman and Chief Executive Officer of Clear Creek Properties, Inc. | | 2004 Director of Bank One Corporation from 1993 to 2004 | | Audit (Chair) |

| Michael A. Neal | | 62 | | Retired Vice Chairman of General Electric Company and Retired Chairman and Chief Executive Officer of GE Capital | | 2014 | | Risk Policy |

Lee R. Raymond (Lead Independent Director) | | 76 | | Retired Chairman and Chief Executive Officer of Exxon Mobil Corporation | | 2001 Director of J.P. Morgan & Co. Incorporated from 1987 to 2000 | | Compensation & Management Development (Chair); Corporate Governance & Nominating |

| William C. Weldon | | 66 | | Retired Chairman and Chief Executive Officer of Johnson & Johnson | | 2005 | | Compensation & Management Development; Corporate Governance & Nominating (Chair) |

| |

1 | Principal standing committees |

| |

2 | Retired from JPMorgan Chase & Co. in 2005 |

|

| |

2 • JPMORGAN CHASE & CO. • 2015 PROXY STATEMENT |

Performance and compensation highlights

|

| | | | |

| JPMorgan Chase & Co. continued its strong performance in 2014 under the leadership of Mr. Dimon and the Firm’s senior management and the oversight of our Board of Directors. Below are highlights relating to the Firm’s performance and compensation program. |

|

| | |

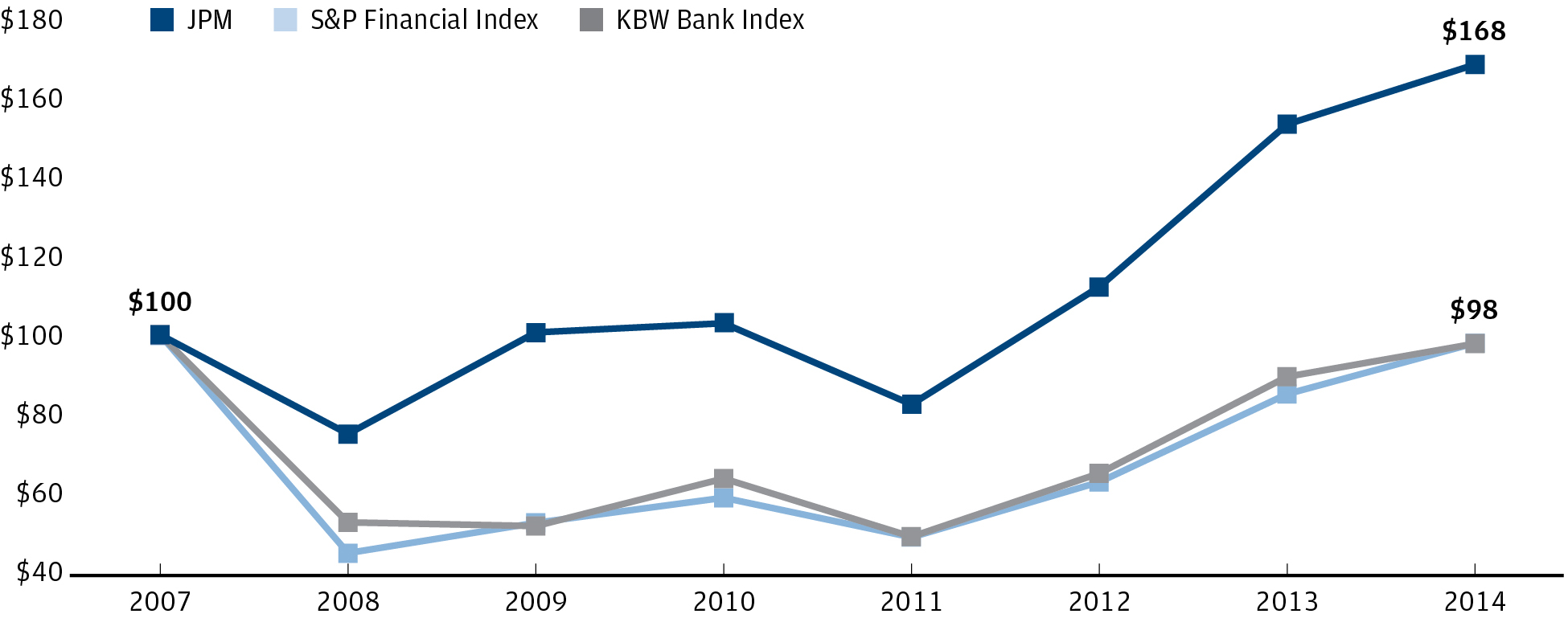

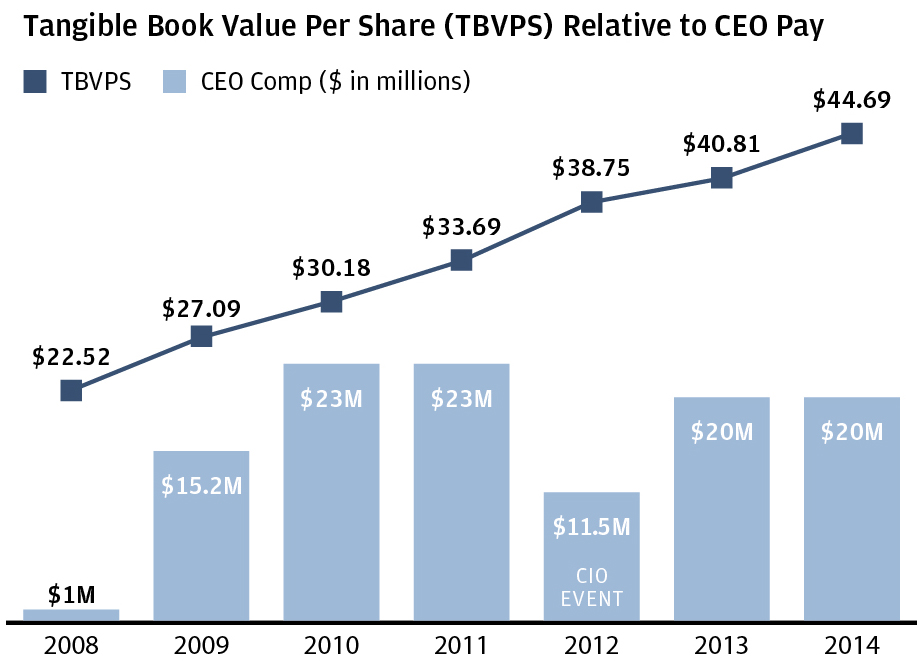

| Strong 2014 performance continues to support sustained shareholder value | | • We generated record net income and EPS, with 13% return on tangible common equity (“ROTCE”) in 2014, with each of our leading client franchises exhibiting strong performance and together delivering significant value. • We delivered 10% total shareholder return (“TSR”) in 2014, following 37% in 2013, and continue to outperform the financial services industry TSR since 2008. • We maintained our fortress balance sheet, while continuing to grow our Basel III Advanced Fully Phased-In common equity Tier 1 (“CET1”) capital ratio and our tangible book value per share. |

|

We maintain fortress operating principles with a focus on risk and controls | | • We have added more than 16,000 employees since the beginning of 2012 to support our regulatory, compliance and control efforts across the entire Firm. • We spent $2 billion more in 2014 than in 2012 on our regulatory and control agenda. • We have simplified our business and re-committed to our culture and business principles. • We have implemented an enhanced process in all lines of business and our corporate functions to discuss material risk and control issues in control forums. • We continued to strengthen the Firm’s leadership through a disciplined talent review process and an enhanced executive development program. |

|

| We have a robust governance structure and are highly responsive to shareholders | | • Our Lead Independent Director role is robust and our Board has endorsed the Shareholder Director Exchange (SDX) Protocol as a guide for engagement. • Our shareholder engagement initiatives during 2014 included: — approximately 90 calls and meetings on governance and compensation topics with shareholders representing approximately 40% of our shares — presentations by Firm senior management at 14 investor conferences — hosting a panel discussion with shareholders, corporate governance professionals, legal professionals and academics regarding major issues related to the Chairman and CEO roles at public companies • Our Board remains strong following the addition of four new independent directors since 2011, including two new Risk Policy Committee members since 2013, with an appropriate balance of board refreshment and Firm experience. |

| | |

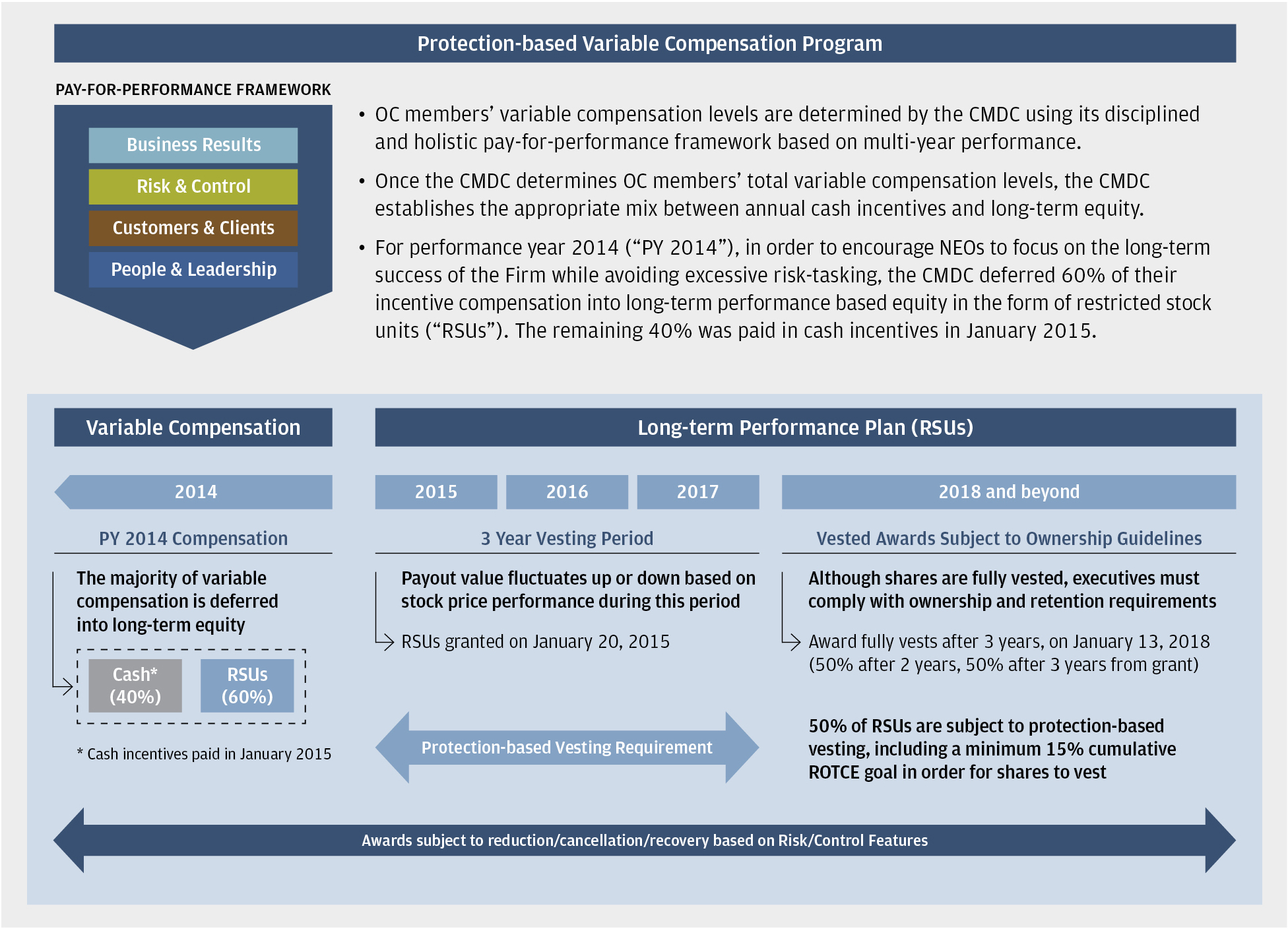

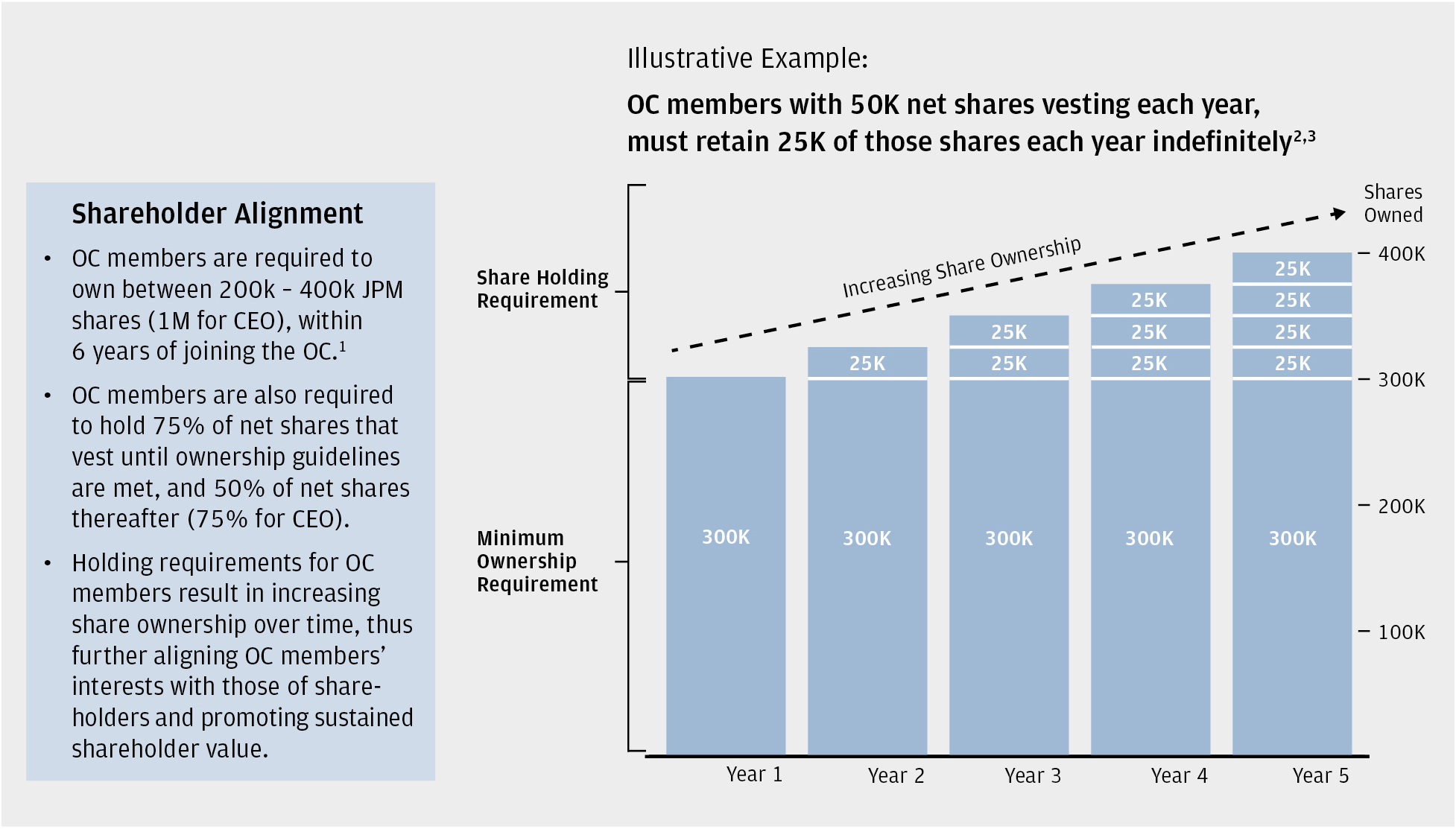

Our compensation program is rigorous and long-term focused | | • Our compensation program and Long-Term Incentive Plan (“LTIP”) reflect the Board’s philosophy of linking compensation to the Firm’s long-term performance including: i) Business Results, ii) Risk & Control, iii) Customers & Clients, and iv) People Management & Leadership. • The majority of Operating Committee pay is delivered in equity with multi-year vesting. • We have strong stock retention requirements and long-standing clawback provisions applicable to both cash incentives and equity awards. • We have been careful stewards of shareholder value, only issuing an average of 1.5% of shares outstanding for employee compensation under our LTIP over the past three years. |

| | |

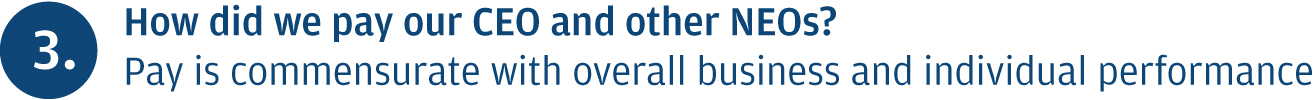

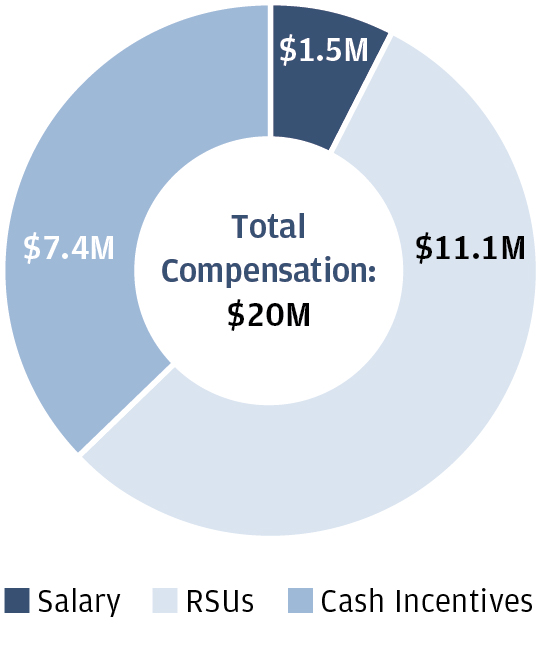

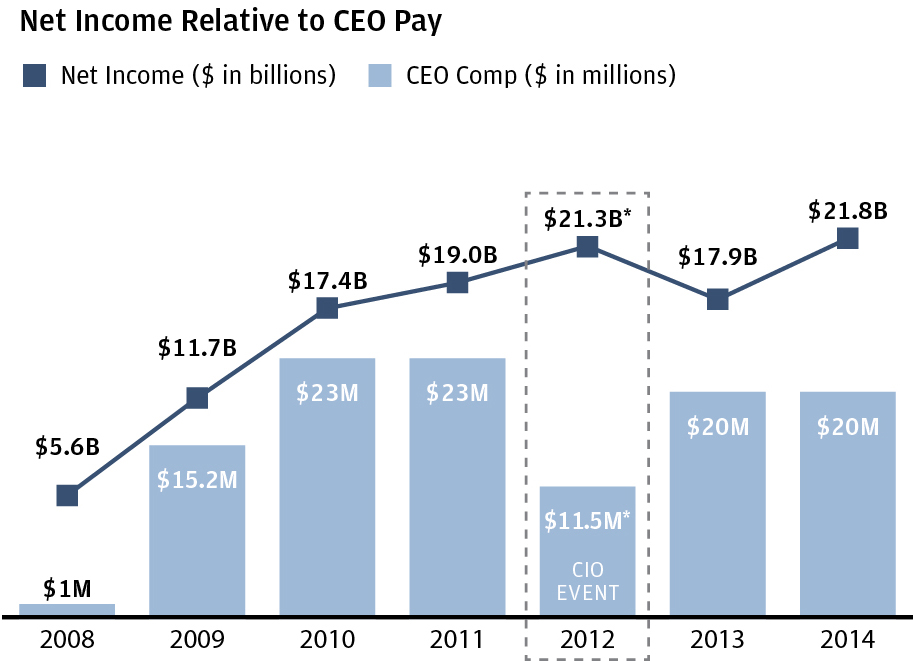

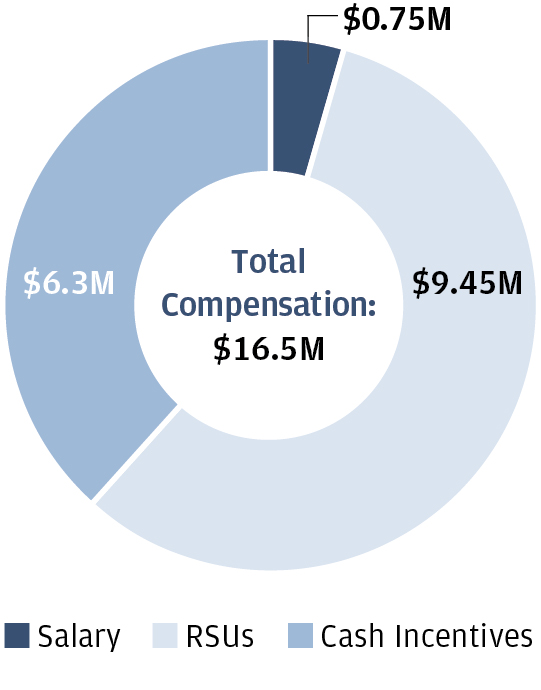

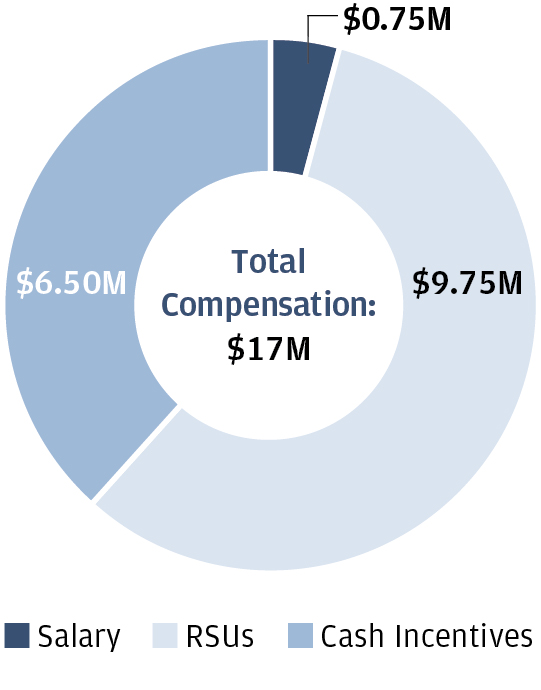

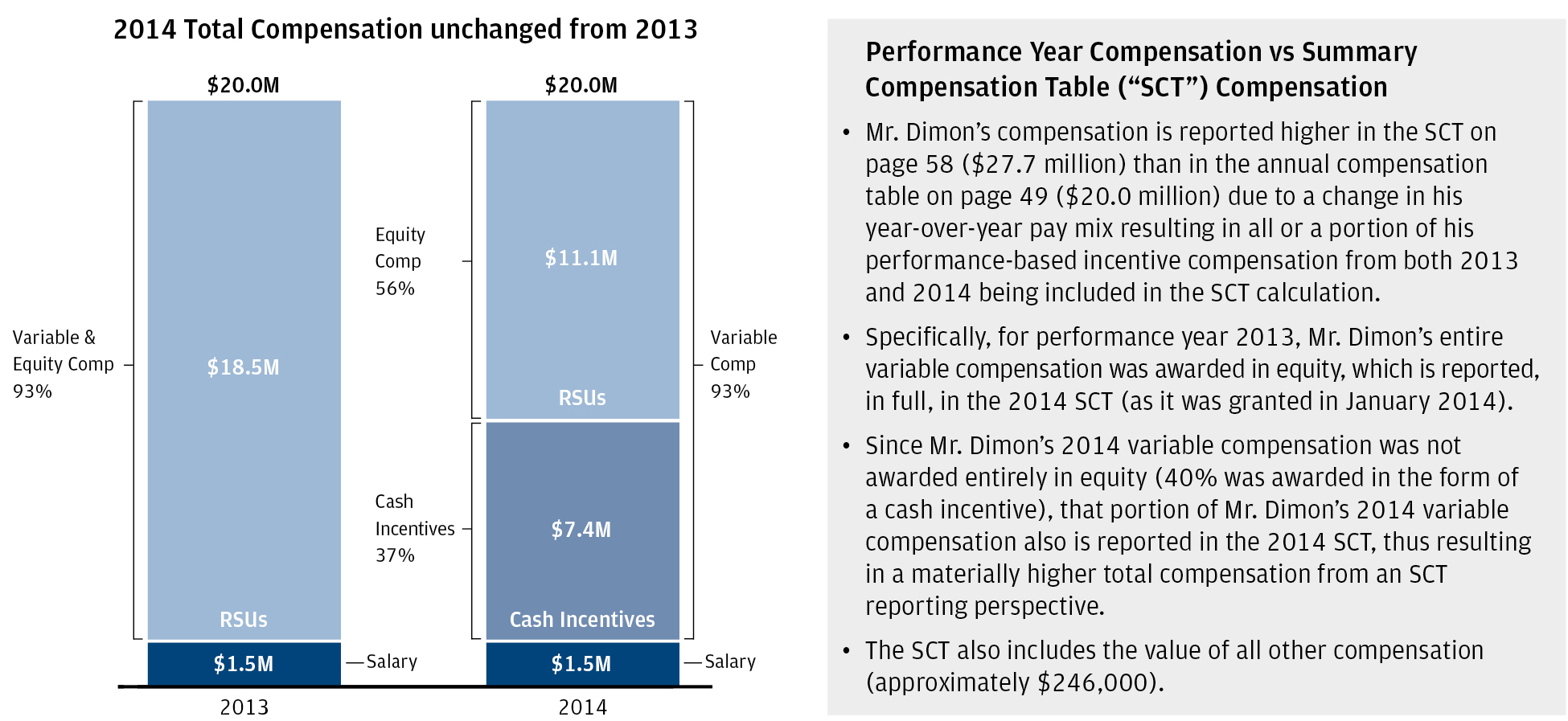

| CEO pay level reflects our performance | | • Mr. Dimon and the other Named Executive Officers (“NEOs”) delivered strong Firm, line of business and individual performance in 2014, continuing their momentum from 2013. • Based on strong 2014 performance and historical performance, the CMDC and Board awarded Mr. Dimon total compensation of $20 million, which is unchanged from 2013. |

|

| |

JPMORGAN CHASE & CO. • 2015 PROXY STATEMENT • 3 |

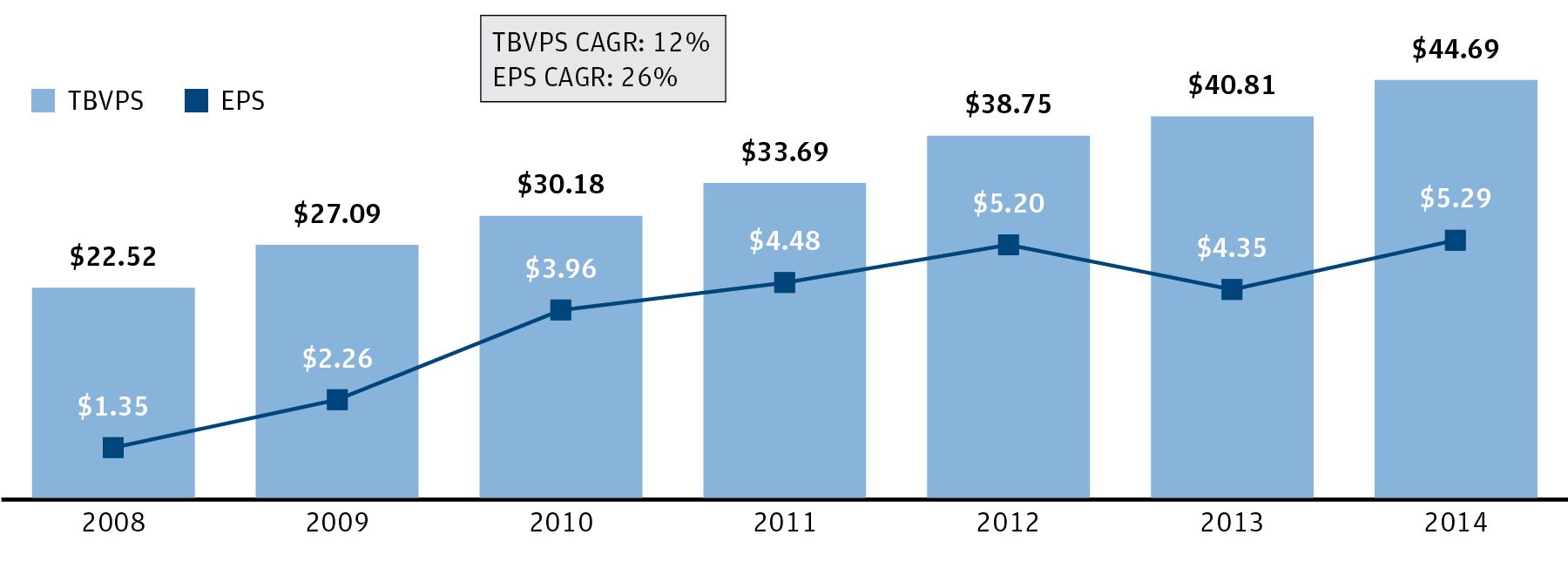

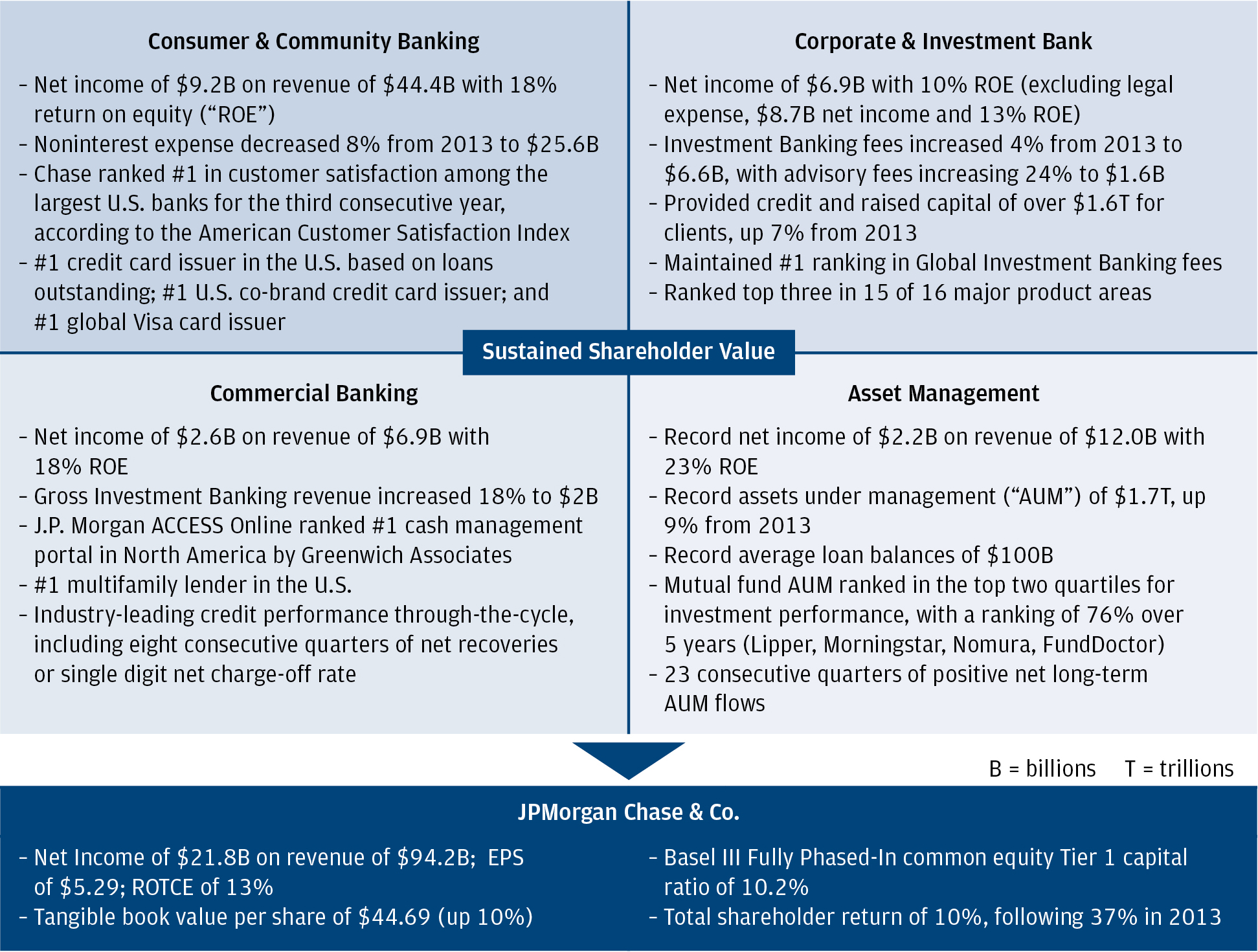

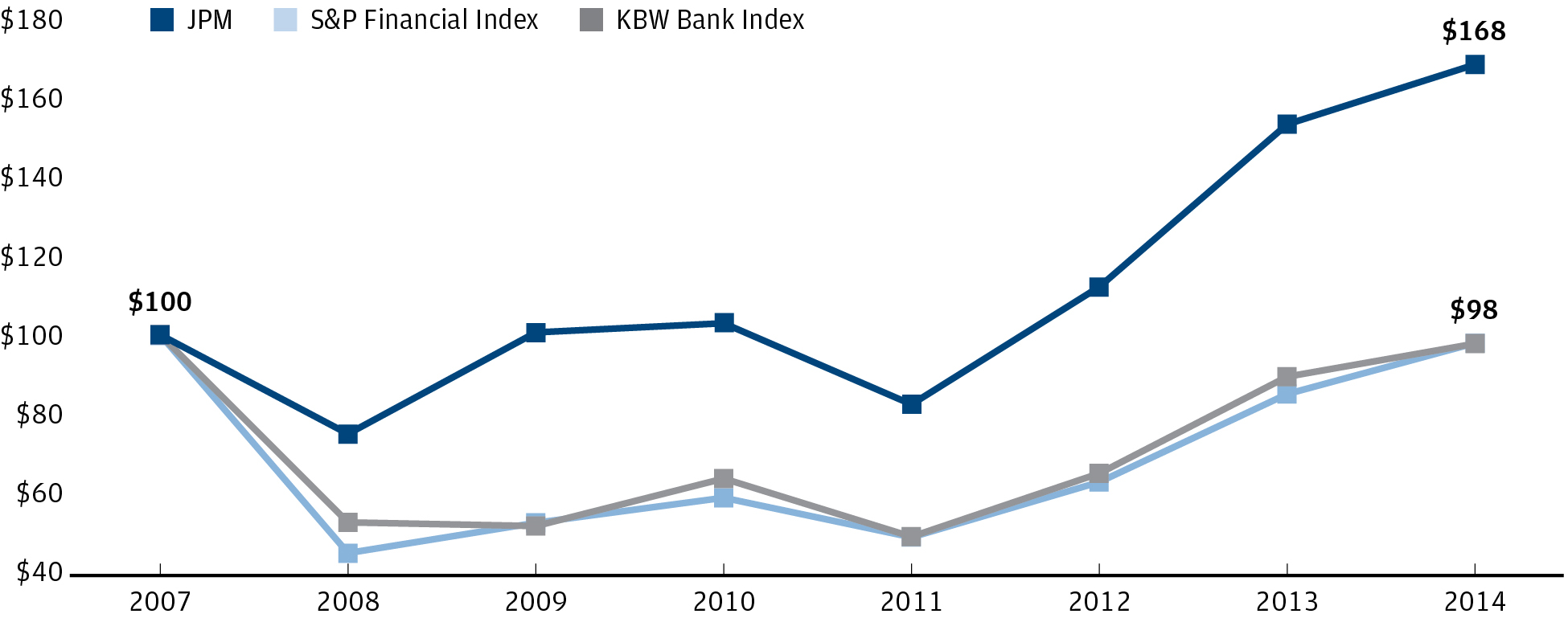

Continued track record of long-term performance in 20141

|

| | |

| Drove strong, sustained performance across all businesses | | Maintained fortress balance sheet and strengthened our capital position |

| | |

• Consumer & Community Banking — $9.2 billion net income and 18% ROE • Corporate & Investment Bank — $6.9 billion net income and 10% ROE (excluding legal expense, $8.7 billion net income and 13% ROE) • Commercial Banking — $2.6 billion net income and 18% ROE • Asset Management — $2.2 billion net income and 23% ROE • Firmwide — $21.8 billion net income and 13% ROTCE, compared to $17.9 billion and 11% in 2013 | | • Ended the year with a Basel III Advanced Fully Phased-in common equity tier 1 capital ratio of 10.2%, significantly above our 2013 ratio of 9.5%, and in line with our target of 10%+ • Made significant progress on regulatory and control agenda |

| Created significant value for shareholders |

| |

| • Delivered sustained shareholder value • Record dividends of $1.58 per share ($6.1 billion in aggregate) • Repurchased $4.8 billion of common shares |

|

| | | | |

| Sustained earnings and tangible book value per share (TBVPS) growth |

|

| | | | |

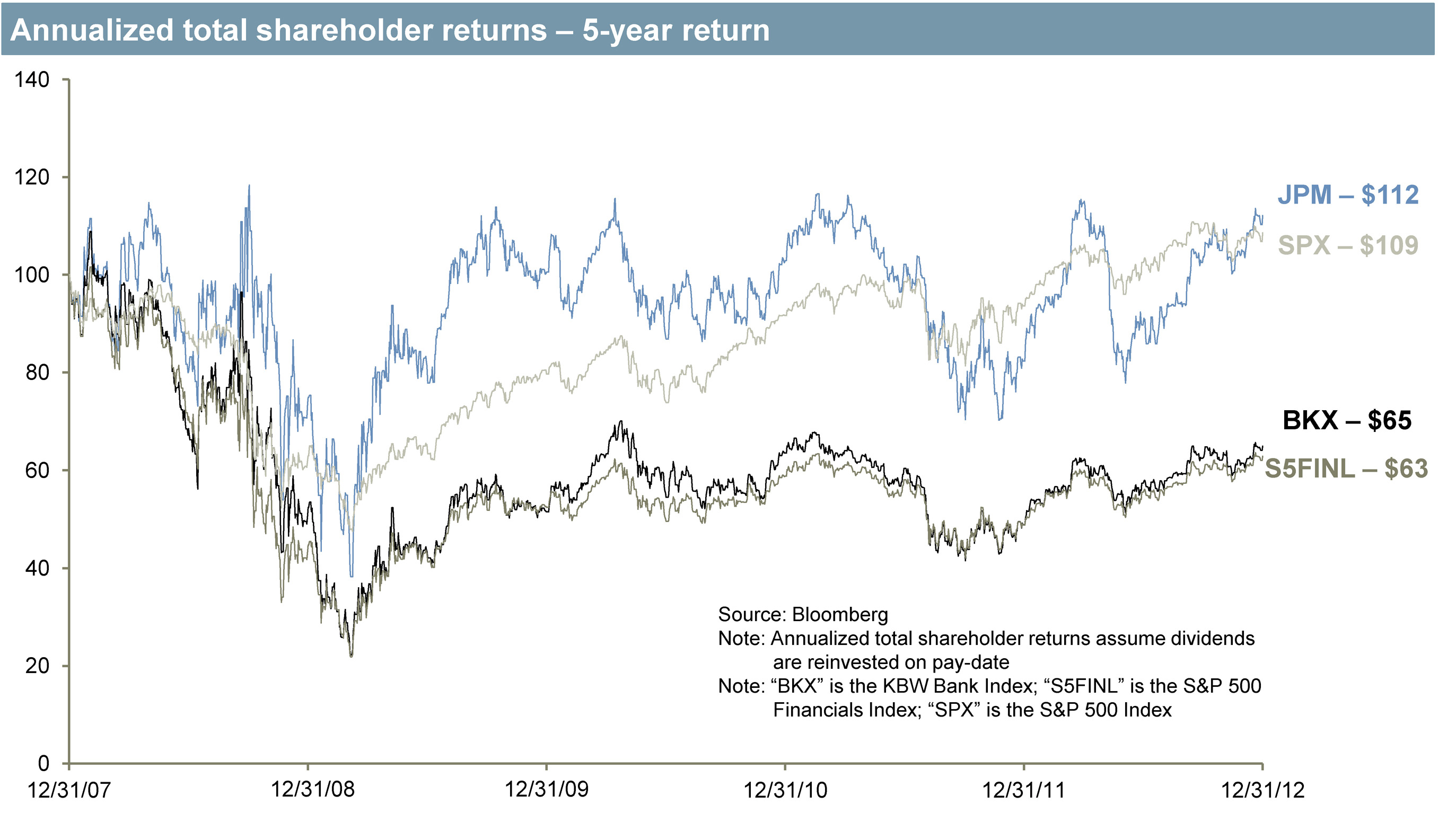

Shareholder value creation over time (TSR)2 |

| |

1 | See notes on non-GAAP financial measures on page 109 of this proxy statement. |

| |

2 | Total shareholder return (“TSR”) assumes reinvestment of dividends. |

|

| |

4 • JPMORGAN CHASE & CO. • 2015 PROXY STATEMENT |

|

| | | | |

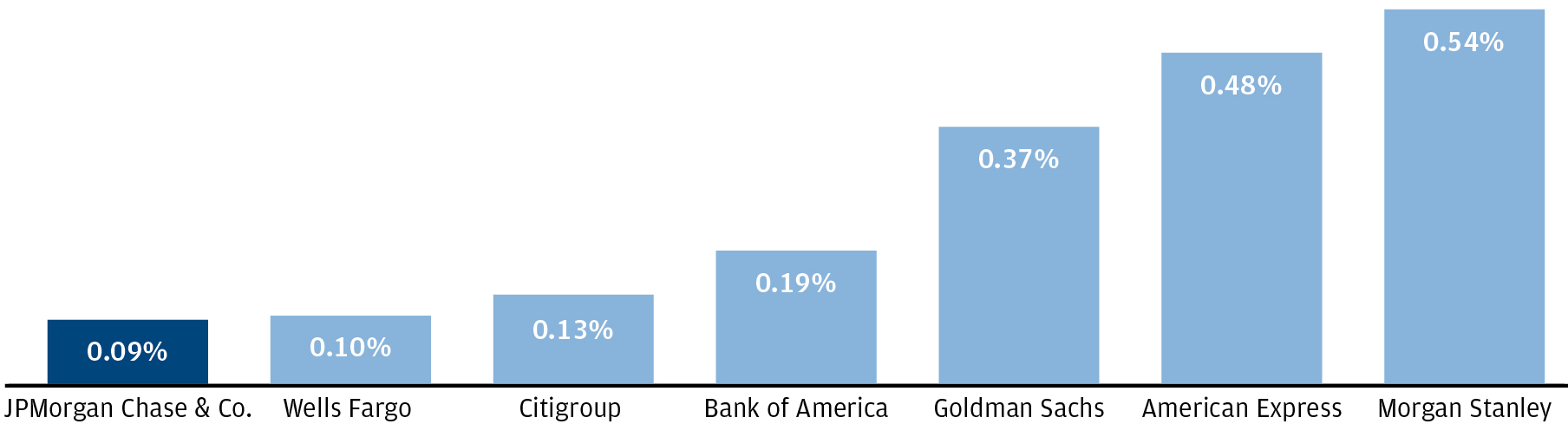

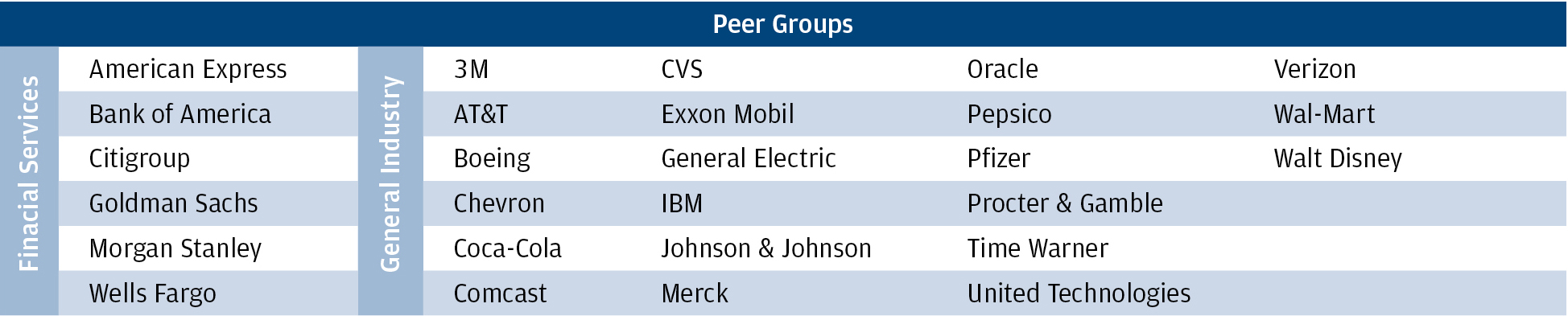

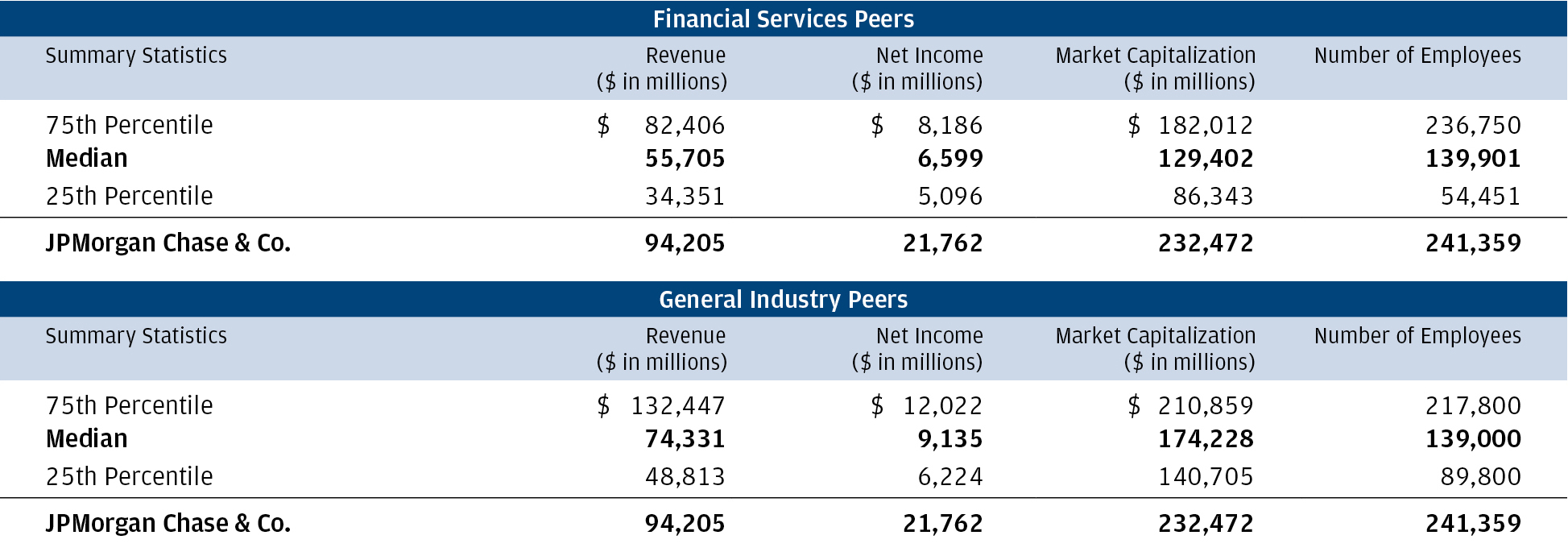

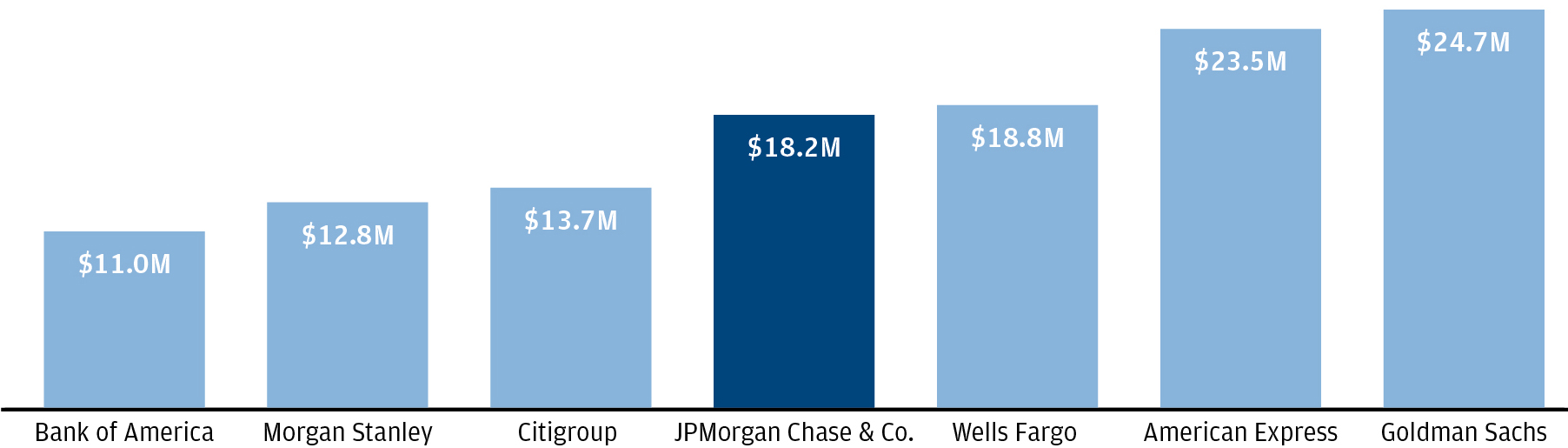

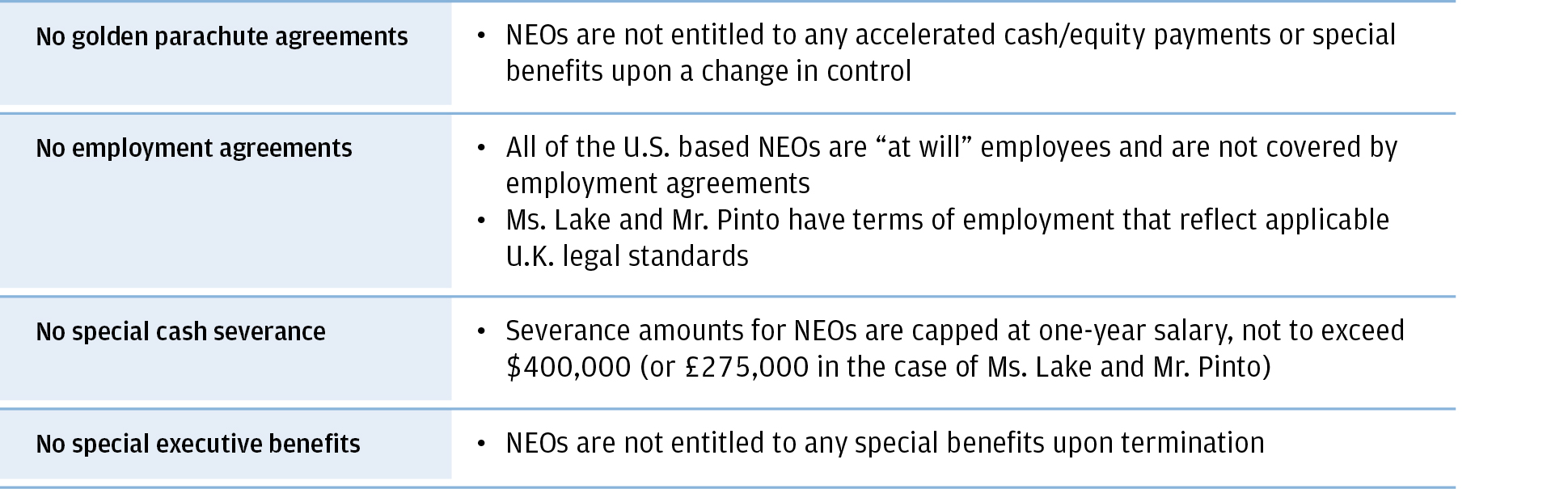

| JPMorgan Chase generated more net income per dollar of CEO compensation than peers |

% of Profits Paid to CEOs — Three Year Average (2011-2013)1

(Financial Services Peer Group)

| |

1 | Percentage of profits paid is equal to three year average CEO compensation divided by three year average net income. Total compensation is based on base salary, actual cash bonus paid in connection with the performance year, and target value of long-term incentives awarded in connection with the performance year. The most recently used data is 2013 since not all of our Financial Services Peer Group will have filed their proxy statements before the preparation of our own proxy statement. Source: Annual reports and proxy statements |

|

| | | | |

| CEO compensation is aligned with performance |

* Despite record net income in 2012, the Board significantly reduced Mr. Dimon’s pay in response to CIO trading losses.

|

| |

JPMORGAN CHASE & CO. • 2015 PROXY STATEMENT • 5 |

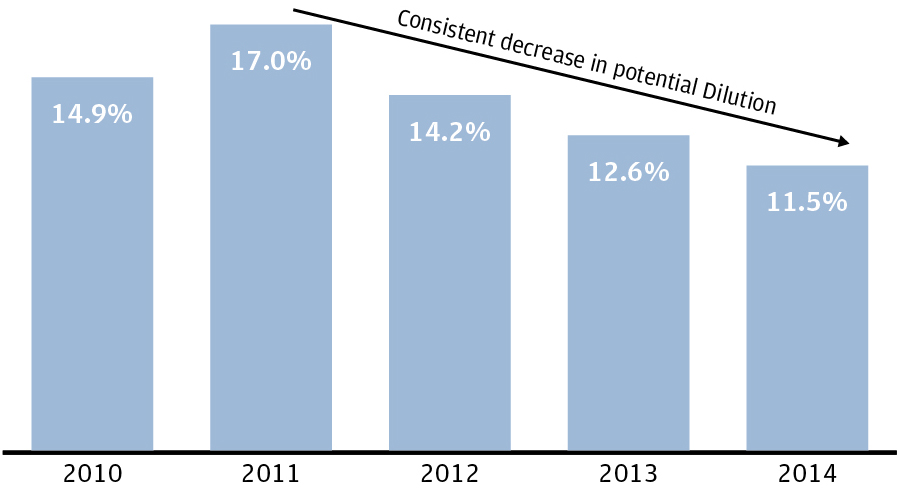

Amendment to Long–Term Incentive Plan

JPMorgan Chase’s Long-Term Incentive Plan (the “Plan”) was last approved by shareholders on May 17, 2011. Pursuant to its terms, the Plan has a four-year duration and will expire on May 31, 2015. The primary purpose of the amendment is to extend the term of the Plan for an additional 4 years (until May 31, 2019), and to authorize 95 million carryover shares from the existing Plan pool (canceling approximately 157 million shares out of the 252 million shares remaining, as of February 28, 2015).

We believe that voting in favor of our proposed amendment to the Firm’s Long-Term Incentive Plan is important, as a well-designed equity program serves to align employees’ long-term economic interests with those of shareholders while incurring reasonable dilution to shareholders. Without such approval, the

Firm would lose a critical shareholder alignment feature of our compensation framework.

The proposal is organized around three key considerations that we believe shareholders should focus on in their evaluation of our Plan:

| |

| 1. | We use shares responsibly and have significantly reduced our request for shares to be made available under the Plan based on shareholder feedback. |

| |

| 2. | Our equity practices promote the long-term interests of shareholders and create a culture of success amongst our employees. |

| |

| 3. | Our equity program reinforces individual accountability through strong recovery provisions. |

|

| | | | |

| We use our shares responsibly |

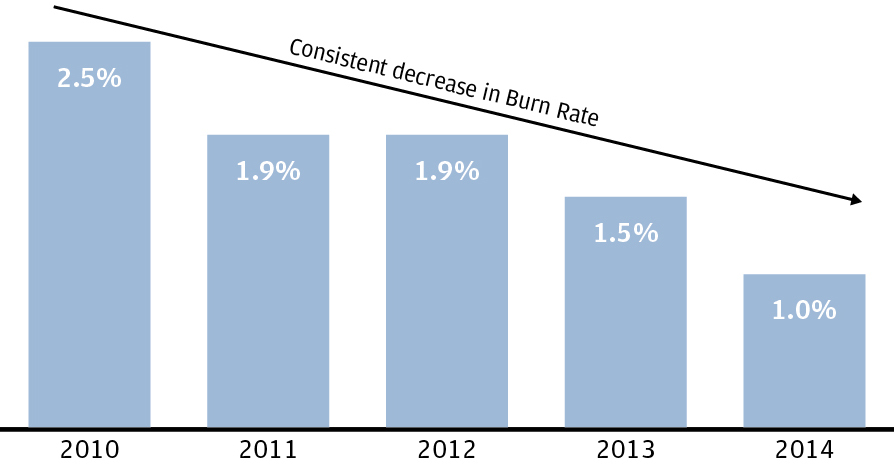

Historical Total Potential Dilution 1

| |

1 | Total Potential Dilution reflects the number of employee and director shares outstanding (including RSUs and SARs) plus the shares remaining in the LTIP Plan pool divided by the number of common shares outstanding at year end (based on Firm’s annual reports). |

| |

2 | Burn Rate reflects the number of shares (including RSUs and SARs) granted to employees and directors in a calendar year divided by the weighted average diluted shares outstanding (based on Firm’s annual reports). |

|

| |

6 • JPMORGAN CHASE & CO. • 2015 PROXY STATEMENT |

Proposal 1:

Election of Directors

Our Board of Directors has nominated 11 directors, who, if elected by shareholders at our annual meeting, will be expected to serve until next year’s annual meeting. All nominees are currently directors.

|

| | | | | |

| RECOMMENDATION: Vote FOR all nominees |

|

Proposal 1 — Election of directors

Our Board has nominated 11 directors for election at this year’s annual meeting to hold office until the next annual meeting and the election of their successors.meeting. All of the nominees are currently directors.directors and were elected to the Board by our shareholders at our 2014 annual meeting, each with the support of more than 96% of votes cast. Each has agreed to be named in this proxy statement and to serve if elected. All of the nominees are expected to attend the our May 21, 2013,19, 2015, annual meeting.

Although weWe know of no reason why any of the nominees would not be ableunable or unwilling to serve if elected. However, if any nomineeof our nominees is unavailable for election, the proxies intend to vote your common stock for any substitute nominee proposed by the Board of Directors.

We believe that each nominee has the skills, experience and personal qualities the Board seeks in its directors and that the combination of these nominees creates an effective and well-functioning Board that serves the best interests of the Firm and our shareholders.

The Board may also chooseof Directors is responsible for overseeing management and providing sound governance on behalf of shareholders. Risk management oversight is a key priority. The Board carries out its responsibilities through, among other things, highly capable independent directors, the Lead Independent Director, a strong committee structure and adherence to reduceour Corporate Governance Principles. The Board conducts an annual assessment aimed at enhancing its effectiveness, as described on page 23 of this proxy statement.

|

|

| DIRECTOR NOMINATION PROCESS |

|

As specified in its charter, the number of directors to be elected, as permitted by our By-laws.

Nomination process

The Board’s Corporate Governance & Nominating Committee (the “Governance(“Governance Committee”) is responsible for evaluatingoversees the candidate nomination process, which includes the evaluation of both existing Board members and recommending to the Board proposed nominees for election to the Board of Directors. The Governance Committee, in consultation with the Chief Executive Officer, periodically reviews the criteria for composition of the Board and evaluates potential new candidates for Board membership. The Governance Committee then makes recommendationsrecommends to the Board a slate of candidates for election at each annual meeting of shareholders. The Governance Committee’s goal is to put forth a diverse slate of candidates with a combination of skills, experience and personal qualities that will well serve the Board and its committees, our Firm and our shareholders. The Governance Committee considers all relevant attributes of each Board candidate, including professional skills, experience and knowledge, as well as gender, race, ethnicity, culture, nationality and background.

Director succession is also a focus of the Governance Committee and the Board. The Governance Committee also takes into account criteria applicable to Board committees.

As stated in the Corporate Governance Principles of the Board (the “Corporate Governance Principles”), in determining Board nominees, the Board wishes to balance the needs for professional knowledge, business expertise, varied industry knowledge, financial expertise, and CEO-level management experience. Following these principles, the Board seeks to select nominees who combine leadershipmaintain an appropriate balance of Board refreshment and business management experience, experienceFirm experience. In service of this goal, the Governance Committee engages in disciplines relevant to the Firm and its businesses, and personal qualities reflecting integrity, judgment, achievement, effectiveness, and willingness to appropriately challenge management.

frequent consideration of potential Board candidates. The Governance Committee is assisted in identifying potential Board strives to ensure diversity of representation among its members.candidates by a third-party advisor. Of the 11Board’s 10 independent directors, four have been added since 2011.

Candidates for director nominees, two are women and one is African-American. Increasing diversity ismay be recommended by current Board members, our management, shareholders or third-party advisors. Shareholders who want to recommend a priority, and when considering prospectscandidate for possible recommendationelection to the Board the Governance Committee reviews available information about the experience, qualifications, attributes and skills of prospects, as well as their gender, race and ethnicity.

The Governance Committee will consider director candidates recommended for considerationmay do so by members of the Board, by management and by shareholders, and will seek diverse slates when considering candidates. Shareholders wishing to recommendwriting to the Governance Committee a candidate for director should write to theCorporate Secretary at: JPMorgan Chase & Co., Office of the Secretary, 270 Park Avenue, New York, New York 10017.

It isNY 10017; or by sending an e-mail to the policyOffice of the Secretary at corporate.secretary@jpmchase.com. The Governance Committee thatconsiders shareholder-recommended candidates on the same basis as nominees recommended by shareholders will be considered in the same manner as other candidatesBoard members, management and there are no additional procedures a shareholder must undertake in order for the Governance Committee to consider such shareholder recommendations.third-party advisors.

Information about the nominees

Boards act collectively and, together, the members of the Board provide the Firm with a breadth of demonstrated senior leadership and management experience in large complex organizations, global marketing, services and operations, regulated industries, wholesale and retail businesses, financial controls and reporting, compensation, governance, management succession, strategic planning and risk management. The director nominees bring broad and varied skills and knowledge from positions in global businesses, not-for-profit organizations and government, and diverse perspectives from a broad spectrum of industries, community activities and other factors. Each possesses the personal characteristics needed for the responsibilities of a director: each has demonstrated significant achievement in his or her endeavors, can work cooperatively and productively in the interest of all

|

| |

JPMorgan Chase8 • JPMORGAN CHASE & Co./ 2013 Proxy Statement | 1CO. • 2015 PROXY STATEMENT |

shareholders, possesses high character and integrity, devotesThe Board of Directors has nominated the necessary time to discharge his or her duties, and,11 individuals listed below for non-management directors, is independent.

The following provides biographical information regarding eachelection as directors. All of the nominees including their specific business experience, qualifications, attributesare currently serving as directors and skills thatall except the CEO are independent. We recommend you vote FOR each director.

|

| | | | | | | | |

| DIRECTOR NOMINEES | | | | |

| The Board has nominated 11 directors: the 10 independent directors and the CEO |

| | | | | | | | | |

| NOMINEE | | AGE | | PRINCIPAL OCCUPATION | | DIRECTOR SINCE | | COMMITTEE MEMBERSHIP 1 |

| Linda B. Bammann | | 59 | | Retired Deputy Head of Risk Management of JPMorgan Chase & Co.2 | | 2013 | | Public Responsibility; Risk Policy |

| James A. Bell | | 66 | | Retired Executive Vice President of The Boeing Company | | 2011 | | Audit |

| Crandall C. Bowles | | 67 | | Chairman of The Springs Company | | 2006 | | Audit; Public Responsibility (Chair) |

| Stephen B. Burke | | 56 | | Chief Executive Officer of NBCUniversal, LLC | | 2004 Director of Bank One Corporation from 2003 to 2004 | | Compensation & Management Development; Corporate Governance & Nominating |

| James S. Crown | | 61 | | President of Henry Crown and Company | | 2004 Director of Bank One Corporation from 1991 to 2004 | | Risk Policy (Chair) |

| James Dimon | | 59 | | Chairman and Chief Executive Officer of JPMorgan Chase & Co.

| | 2004 Chairman of the Board of Bank One Corporation from 2000 to 2004 | | |

| Timothy P. Flynn | | 58 | | Retired Chairman and Chief Executive Officer of KPMG | | 2012 | | Public Responsibility; Risk Policy |

| Laban P. Jackson, Jr. | | 72 | | Chairman and Chief Executive Officer of Clear Creek Properties, Inc. | | 2004 Director of Bank One Corporation from 1993 to 2004 | | Audit (Chair) |

| Michael A. Neal | | 62 | | Retired Vice Chairman of General Electric Company and Retired Chairman and Chief Executive Officer of GE Capital | | 2014 | | Risk Policy |

Lee R. Raymond (Lead Independent Director) | | 76 | | Retired Chairman and Chief Executive Officer of Exxon Mobil Corporation | | 2001 Director of J.P. Morgan & Co. Incorporated from 1987 to 2000 | | Compensation & Management Development (Chair); Corporate Governance & Nominating |

| William C. Weldon | | 66 | | Retired Chairman and Chief Executive Officer of Johnson & Johnson | | 2005 | | Compensation & Management Development; Corporate Governance & Nominating (Chair) |

| |

1 | Principal standing committees |

| |

2 | Retired from JPMorgan Chase & Co. in 2005 |

|

| |

JPMORGAN CHASE & CO. • 2015 PROXY STATEMENT • 9 |

In selecting candidates for director, the Board considered,looks for individuals with strong personal attributes, diverse backgrounds and demonstrated expertise and success in addition to their prior serviceone or more specific executive disciplines.

|

| | | | |

| Executive disciplines |

| Finance and accounting |

| | | | |

| Financial services |

| | | | |

| International business operations |

| | | | |

| Leadership of a large, complex organization |

| | | | |

| Management development and succession planning |

| | | | |

| Public-company governance |

| | | | |

| Regulated industries and regulatory issues |

| | | | |

| Risk management and controls |

|

| | | | |

| Personal attributes |

| Ability to work collaboratively |

| | | | |

| Integrity |

| | | | |

| Judgment |

| | | | |

| Strength of conviction |

| | | | |

| Strong work ethic |

| | | | |

| Willingness to engage and provide active oversight |

The Firm’s director criteria are also discussed in the Corporate Governance Principles document available on our website at jpmorganchase.com, under the heading Governance, which is under the About Us tab.

|

|

| NOMINEES’ QUALIFICATIONS AND EXPERIENCE |

|

Our Board when it determined to nominate them.believes that these nominees provide our Firm with the combined skills, experience and personal qualities needed for an effective and engaged Board.

The specific experience and qualifications of each nominee are described in the following pages. Unless stated otherwise, all of the nominees have been continuously employed by their present employers for more than five years. The age indicated in each nominee’s biography is as of May 21, 2013,19, 2015, and all other biographical information is as of the date of this

proxy statement. Our directors are involved in various charitable and community activities and we have listed a number

|

| |

10 • JPMORGAN CHASE & CO. • 2015 PROXY STATEMENT |

Linda B. Bammann, 59

|

| | |

| | Director since 2013 Public Responsibility Committee Risk Policy Committee Retired Deputy Head of Risk Management of JPMorgan Chase & Co. |

|

| | | |

| DIRECTOR QUALIFICATION HIGHLIGHTS |

| • | | Experience with regulatory issues |

| • | | Extensive background in risk management |

| • | | Financial services experience |

Linda B. Bammann was Deputy Head of Risk Management at JPMorgan Chase from July 2004 until her retirement in 2005. Previously she was Executive Vice President and Chief Risk Management Officer at Bank One Corporation (“Bank One”) from May 2001 to July 2004, and, before then, Senior Managing Director of Banc One Capital Markets, Inc. She was also a member of Bank One’s executive planning group. From 1992 to 2000 she was a Managing Director with UBS Warburg LLC and predecessor firms.

Ms. Bammann served as a director of The Federal Home Mortgage Corporation (“Freddie Mac”) from 2008 until 2013, during which time she was a member of its Compensation Committee. She also served as a member of Freddie Mac’s Audit Committee from 2008 until 2010 and as Chair of its Business and Risk Committee from 2010 until 2013. Ms. Bammann also served as a director of Manulife Financial Corporation from 2009 until 2012. Ms. Bammann was formerly a board member of the Risk Management Association and Chair of the Loan Syndications and Trading Association.

Through her experience on the boards of other public companies and her tenure with JPMorgan Chase and Bank One, Ms. Bammann has developed insight and wide-ranging experience in financial services and extensive expertise in risk management and regulatory issues.

Ms. Bammann graduated from Stanford University and received an M.A. degree in public policy from the University of Michigan.

James A. Bell, 66

|

| | |

| | | | |

James A. Bell, 64 |

Director since 2011 Audit Committee Retired Executive Vice President of The Boeing Company aerospace |

|

Director since 2011 | | | |

| DIRECTOR QUALIFICATION HIGHLIGHTS |

| | • | | Finance and accounting experience |

| | • | | Leadership of complex, multi-disciplinary global organization |

| • | | Regulatory issues and regulated industry experience |

Mr.James A. Bell was an Executive Vice President of The Boeing Company, the world’s largestan aerospace company and manufacturer of commercial jetliners and military aircraft, from 2003 until his retirement in April 2012. He had beenwas Corporate President from June 2008 until February 2012 and was Chief Financial Officer from November 2003 until February 2012.

Over a four-decade corporate career, Mr. Bell led global businesses in a highly regulated industry, oversaw successful strategic growth initiatives and developed expertise in finance, accounting, risk management and controls. While Chief Financial Officer, he oversaw two key Boeing businesses,businesses: Boeing Capital Corporation, the company’s customer-financing subsidiary, and Boeing Shared Services, an 8,000-person, multi-billion dollar business unit that provides common internal services across Boeing’s global enterprise. He is a director of Dow Chemical Company (since 2005).

Prior toBefore being named Chief Financial Officer, in 2003, Mr. Bell held the position ofwas Senior Vice President of Finance and Corporate Controller from 2000 andController. In this position he served as the company’s principal interface with the board’s Audit Committee. He was Vice President of contracts and pricing for Boeing Space and Communications from 1996 to 2000. Before becoming Vice President at the operating group level in 1996, Mr. Bell2000, and before that served as director of business management of the Space Station Electric Power System at the Boeing Rocketdyne unit. Mr. Bell began his career with Rockwell in 1972.

Mr. Bell graduated California State University at Los Angeles withhas been a degree in accounting.director of Dow Chemical Company since 2005. He is a member of the boardBoard of directors of the Chicago Urban League and the Chicago Economic Club.Trustees at Rush University Medical Center.

Mr. Bell has had global business and leadership experience overseeing business performance and strategic growth initiativesgraduated from California State University at Boeing. His finance and accounting expertise included experience with and direct involvement and supervision in the preparationLos Angeles.

|

| |

JPMORGAN CHASE & CO. • 2015 PROXY STATEMENT • 11 |

Crandall C. Bowles, 67

|

| | |

| | Director since 2006 Audit Committee Public Responsibility Committee (Chair) Chairman of The Springs Company |

|

| | | | |

| | | | |

Crandall C. Bowles, 65 |

Chairman of Springs Industries, Inc., window fashions |

Director since 2006DIRECTOR QUALIFICATION HIGHLIGHTS |

| | • | | International business operations experience |

| | • | | Management development, compensation and succession planning experience |

| • | | Risk management and audit experience |

Ms.Crandall C. Bowles has been Chairman of The Springs Company, a privately owned investment company, since 2007. She also served as Chairman of Springs Industries, Inc., a manufacturer of window products for the home, sincefrom 1998 anduntil June 2013 when the business was sold. She was a member of its board since 1978. From 1998from 1978 until 2006, sheJune 2013 and was also Chief Executive Officer offrom 1998 until 2006. Prior to 2006, Springs Industries Inc. Subsequentincluded bed, bath and home-furnishings business lines. These were merged with a Brazilian textile firm to a spinoff and merger in 2006, she was Co-Chairman and Co-CEO ofbecome Springs Global Participacoes S.A., a textile home furnishingshome-furnishings company based in Brazil, where Ms. Bowles served as Co-Chairman and Co-CEO from 2006 until her retirement in July 2007.

Ms. Bowles ishas been a director of Deere & Company (since 1999 and previously from 1990 to 1994).since 1999. She previously served as a director of Sara Lee Corporation (2008-2012)from 2008 to 2012 and of Wachovia Corporation (1991–1996).

|

| |

2 | JPMorgan Chase & Co./ 2013 Proxy Statement |

Ms. Bowles graduated from Wellesley Collegeand Duke Energy in 1969 and earnedthe 1990s. As an MBA from Columbia University in 1973. She is a trustee of the Brookings Institution and is on the governing boards of the Packard Center at Johns Hopkins and The Wilderness Society.

Ms. Bowles has extensive experience managing large complex business organizationsexecutive at Springs Industries Inc. and Springs Global Participacoes, S.A. At thoseMs. Bowles gained experience managing international business organizations. As a board member of large, global companies, and through her current and prior service on other public company boards, she has dealt with a wide range of issues including audit and financial reporting, risk management, and executive compensation international business, and sales succession planning.

Ms. Bowles is a Trustee of the Brookings Institution

and marketingis on the governing boards of consumer productsthe Packard Center for ALS Research at Johns Hopkins and services. Her philanthropic activities give her valuable perspective on important societalThe Wilderness Society.

Ms. Bowles graduated from Wellesley College and economic issues relevant to the Firm’s business.received an M.B.A from Columbia University.

|

| | | | |

| | | | |

Stephen B. Burke, 54 |

Chief Executive Officer of NBCUniversal, LLC and Executive Vice President of Comcast Corporation, television and entertainment |

Director since 2004 and Director of Bank One Corporation from 2003 to 2004 Compensation & Management Development Committee Corporate Governance & Nominating Committee Chief Executive Officer of NBCUniversal, LLC |

|

| | | |

| DIRECTOR QUALIFICATION HIGHLIGHTS |

| | • | | Experience leading large, international, complex businesses in regulated industries |

| • | | Financial controls and reporting experience |

| • | | Management development, compensation and succession planning experience |

Mr.Stephen B. Burke has been Chief Executive Officer of NBCUniversal, LLC, and Executive Vice President of Comcast Corporation since January 2011. He had been Chief Operating Officera senior executive of Comcast Corporation, one of the nation’s leading providers of entertainment, information and communication products and services, since January 2011. He was Chief Operating Officer of Comcast Corporation from 2004 until 2011, and was President of Comcast Cable Communications, Inc. from 1998 until January 2010.

Before joining Comcast, heMr. Burke served with The Walt Disney Company as President of ABC Broadcasting. Mr. BurkeHe joined The Walt Disney Company in January 1986, where heand helped to develop and found The Disney Store and helped to lead a comprehensive restructuring effort of Euro Disney S.A. Mr. Burke is a director of Berkshire Hathaway Inc. (since 2009).

Mr. Burke graduated from Colgate University in 1980 and received an MBA from Harvard Business School in 1982. He is Chairman of The Children’s Hospital of Philadelphia.

Mr. Burke’s roles at Comcast, ABC, Broadcasting, and Euro Disney have given him broad exposure to the challenges associated with managing a large and diverse business.businesses. In those roles he has dealt with a variety of issues including audit and financial reporting, risk management, executive compensation, sales and marketing, and technology and operations. In addition,His tenure at Comcast and ABC Broadcasting have providedgave him with experience working in regulated industries, and his work at Euro Disney has givengave him a background in international business experience.

|

| | | | |

| | | | |

David M. Cote, 60 |

Chairman and Chief Executive Officer of Honeywell International Inc., diversified technology and manufacturing |

Director since 2007 |

| | | |

business.Mr. Cote is Chairman and Chief Executive Officer of Honeywell International Inc., a diversified technology and manufacturing leader, serving customers worldwide with aerospace products and services; control technologies for buildings, homes and industry; turbochargers; and specialty materials. He was elected President and Chief Executive Officer in February 2002, and was named Chairman of the Board in July 2002. Prior to joining Honeywell, he served as Chairman, President and Chief Executive Officer of TRW Inc., which he joined in 1999 after a 25 year career with General Electric. Mr. Cote isBurke has been a director of Honeywell InternationalBerkshire Hathaway Inc. (since 2002).since 2009.

Mr. CoteBurke graduated from theColgate University of New Hampshire in 1976. In 2010, he was named by President Obama to serve on the bipartisan National Commission on Fiscal Responsibility and Reform. Mr. Cote was named co-chair of the U.S.-India CEO Forum by President Obama in 2009, and has served on the Forum since July 2005. Mr. Cote is a member of Thereceived an M.B.A. from Harvard Business Roundtable and serves on an advisory panel to Kohlberg Kravis Roberts & Co.School.

|

| |

JPMorgan Chase12 • JPMORGAN CHASE & Co./ 2013 Proxy Statement | 3CO. • 2015 PROXY STATEMENT |

At Honeywell and TRW, Mr. Cote gained experience dealing with a variety of issues relevant to the Firm’s business, including audit and financial reporting, risk management, executive compensation, sales and marketing of industrial and consumer goods and services, and technology matters. He also has extensive experience in international business issues and public policy matters. His record of public service further enhances his value to the Board.

|

| | | | |

| | | | |

James S. Crown, 59 |

President of Henry Crown and Company, diversified investments |

Director since 2004 and Director of Bank One Corporation from 1991 to 2004 Risk Policy Committee (Chair) President of Henry Crown and Company |

|

| | | |

| DIRECTOR QUALIFICATION HIGHLIGHTS |

| | • | | Extensive risk management experience |

| | • | | Management development, compensation and succession planning experience |

| • | | Significant financial markets experience |

Mr.James S. Crown joined Henry Crown and Company, a privately owned investment company whichthat invests in public and private securities, real estate and operating companies, in 1985 as Vice President and became President in 2002. Before joining Henry Crown and Company, Mr. Crown iswas a Vice President of Salomon Brothers Inc. Capital Markets Service Group.

Mr. Crown has been a director of General Dynamics Corporation (since 1987).since 1987 and has served as its Lead Director since 2010. He ishas also been a director of JPMorgan Chase Bank, N.A., a wholly-owned subsidiary of the Firm (since 2010). He previouslysince 2010. Mr. Crown served as a director of Sara Lee Corporation (1998–2012).

Mr. Crown graduated from Hampshire College in 1976 and received his law degree from Stanford University Law School in 1980. Following law school, Mr. Crown joined Salomon Brothers Inc. and became a vice president of the Capital Markets Service Group in 1983. In 1985 he joined his family’s investment firm. He is a Trustee of the University of Chicago Medical Center, the Museum of Science and Industry, The Aspen Institute, the University of Chicago, and the Chicago Symphony Orchestra. He is a member of the American Academy of Arts and Sciences.1998 to 2012.

Mr. Crown’s position with Henry Crown and Company and his service on other public company boards have given him exposure to many issues encountered by the Firm’sour Board, including risk management, audit and financial reporting, investment management, risk management,capital markets activity, and executive compensation. His legal training gives him enhanced perspective on legal

Mr. Crown is a Trustee of the Aspen Institute, the Chicago Symphony Orchestra, the Museum of Science and regulatory issues.Industry, the University of Chicago and the University of Chicago Medical Center. He is experienced in investment banking and capital markets matters through his prior work experience and subsequent responsibilities. The broad range of his philanthropic activities, in the Chicago area in particular, gives him important insight into the community concerns of onealso a member of the Firm’s largest markets.American Academy of Arts and Sciences.

Mr. Crown graduated from Hampshire College and received a law degree from Stanford University Law School.

|

| | | | | |

| | | | | |

| James Dimon, 57 |

| Chairman and Chief Executive Officer of JPMorgan Chase |

| Director since 2004 and Chairman of the Board of Bank One Corporation from 2000 to 2004 Chairman and Chief Executive Officer of JPMorgan Chase & Co. |

|

| | | |

| DIRECTOR QUALIFICATION HIGHLIGHTS |

| | • | | Experience leading a global business in a regulated industry |

| | • | | Extensive experience leading complex international financial services businesses |

| • | | Management development, compensation and succession planning experience |

Mr.James Dimon became Chairman of the Board on December 31, 2006, and has been Chief Executive Officer and President since December 31, 2005. He had beenwas President and Chief Operating Officer sincefollowing JPMorgan Chase’s merger with Bank One Corporation in July 2004. At Bank One he had beenwas Chairman and Chief Executive Officer sincefrom March 2000. Prior2000 to July 2004. Before joining Bank One, Mr. Dimon had extensive experienceheld a wide range of executive roles at Citigroup Inc., the Travelers Group, Commercial Credit Company and American Express Company.

Mr. Dimon graduated from Tufts University in 1978 and received an MBA from Harvard Business School in 1982. He servesis on the Board of Directors of Harvard Business School and Catalyst and is a member of The Business Council. He is also on the Board of Trustees of New York University School of Medicine. Mr. Dimon does not serve on the board of any publicly traded company other than JPMorgan Chase.

Mr. Dimon has many years of experience in the financial services business, both wholesale and retail,industry, as well as international and domestic experience.business expertise. As CEO, he is intimately familiar withknowledgeable about all aspects of the Firm’s business activities. In addition to the JPMorgan Chase merger with Bank One, he led the Firm’s successful acquisition and integration of The Bear Stearns Companies Inc. and the banking operations of Washington Mutual Bank. His business experience and his former service on the board of the Federal Reserve Bank of New York havework has given him substantial experience in dealing with government officials and agencies and insight into the regulatory process.

Mr. Dimon graduated from Tufts University and received an M.B.A. from Harvard Business School.

|

| |

4 | JPMorgan ChaseJPMORGAN CHASE & Co./ 2013 Proxy StatementCO. • 2015 PROXY STATEMENT • 13 |

Timothy P. Flynn, 58

|

| | |

| | Director since 2012 Public Responsibility Committee

Risk Policy Committee Retired Chairman and Chief Executive Officer of KPMG |

|

| | | | |

| | | | |

Timothy P. Flynn, 56 |

Retired Chairman of KPMG International, professional services |

Director since May 2012DIRECTOR QUALIFICATION HIGHLIGHTS |

| | • | | Experience in financial services, accounting, auditing and controls |

| | • | | Leadership of a complex, global business |

| • | | Risk management and regulatory experience |

Mr.Timothy P. Flynn was Chairman of KPMG International, a global professional services organization that provides audit, tax and advisory services, from 2007 until his retirement in October 2011. KPMG International is a professional services organization which provides audit, taxFrom 2005 until 2010 he served as Chairman and advisory services in 152 countries. He was also Chairman (2005–2010) andfrom 2005 to 2008 as Chief Executive Officer (2005–2008) of KPMG LLP in the U.S. and, the largest individual member firm of KPMG International. Mr. Flynn is a director of Wal-Mart Stores, Inc. (since 2012).

Mr. Flynn held a number of key leadership positions throughout his 32 years at KMPG, providing him with perspective on the issues facing major companies and the evolving business environment. Additionally, he has extensive experience in financial services and risk management. Prior toBefore serving as Chairman and Chief Executive Officer,CEO, Mr. Flynn served, among other positions, aswas Vice Chairman, Audit and Risk Advisory Services, with operating responsibility for the audit practice, as well as theAudit, Risk Advisory and Financial Advisory Services practices.

Through his leadership positions at KPMG, Mr. Flynn holdsgained perspective on the evolving business and regulatory environment, experience with many of the issues facing complex, global companies, and expertise in financial services and risk management.

Mr. Flynn has been a bachelors degree in accountingdirector of Wal-Mart Stores, Inc. since 2012 and of the Chubb Corporation since September 2013. He previously served as a Trustee of the Financial Accounting Standards Board, a member of the World Economic Forum’s International Business Council, and a founding member of The Prince of Wales’ International Integrated Reporting Committee.

Mr. Flynn graduated from The University of St. Thomas, St. Paul, Minnesota and is a member of their Board of Trustees. He has previously served as a trustee of the Financial Accounting Standards Board, a member of the World Economic Forum’s International Business Counsel, and a founding member of The Prince of Wales’ International Integrated Reporting Committee.

Mr. Flynn combines leadership and business experience in a global setting with experience in accounting, auditing, financial services, risk management and regulatory affairs.

Laban P. Jackson, Jr., 72 |

| | | | |

| | | | |

Ellen V. Futter, 63 |

President and Trustee of the American Museum of Natural History |

Director since 2001 and Director of J.P. Morgan & Co. Incorporated from 1997 to 2000 |

| | | |

Ms. Futter became President of the American Museum of Natural History in 1993, prior to which she had been President of Barnard College since 1981. The Museum is one of the world’s preeminent scientific, educational and cultural institutions. Her career began at Milbank, Tweed, Hadley & McCloy where she practiced corporate law. Ms. Futter is a director of Consolidated Edison, Inc. (since 1997) and was previously a director of American International Group Inc. (1999–2008) and Viacom (2006–2007). She was a director of the Federal Reserve Bank of New York (1988–1993) and served as its Chairman (1992–1993).

Ms. Futter graduated from Barnard College in 1971 and earned a law degree from Columbia Law School in 1974. She is a member of the Board of Overseers and Managers of Memorial Sloan-Kettering Cancer Center, a Fellow of the American Academy of Arts and Sciences and a member of the Council on Foreign Relations. Ms. Futter is also a trustee of the Brookings Institution, and a director of The American Ditchley Foundation and NYC & Company.

Ms. Futter has managed large educational and not-for-profit organizations, Barnard College and the American Museum of Natural History, and in that capacity, she has dealt with many complex organizational issues. Such work and her service on public company boards and the board of the Federal Reserve Bank of New York have given her experience with regulated enterprises, in particular the financial services industry, and with risk management, executive compensation, and audit and financial reporting. In her role at the Federal Reserve Bank of New York she also acquired valuable experience dealing with government officials and agencies. Her years of practicing corporate law give her enhanced perspective on legal and regulatory issues. Her extensive experience with philanthropic organizations provides her with insights that are relevant to the Firm’s corporate responsibility initiatives.

|

| |

JPMorgan Chase & Co./ 2013 Proxy Statement | 5 |

|

| | | | |

| | | | |

Laban P. Jackson, Jr., 70 |

Chairman and Chief Executive Officer of Clear Creek Properties, Inc., real estate development |

| Director since 2004 and Director of Bank One Corporation from 1993 to 2004 Audit Committee (Chair) Chairman and Chief Executive Officer of Clear Creek Properties, Inc. |

|

| | | |

| DIRECTOR QUALIFICATION HIGHLIGHTS |

| | • | | Experience in financial controls and reporting and risk management |

| • | | Extensive regulatory background |

| • | | Management development, compensation and succession planning experience |

Mr.Laban P. Jackson, Jr. has been Chairman and Chief Executive Officer of Clear Creek Properties, Inc., a real estate development company, since 1989. He ishas been a director of J.P. Morgan Securities plc and of JPMorgan Chase Bank, N.A., wholly-owned subsidiaries of the Firm (since 2010). He previously served as director of The Home Depot (2004–2008). since 2010.

Mr. Jackson graduated from the United States Military Academy in 1965. He was a director of the Federal Reserve Bank of Cleveland (1987–1992). Mr. Jackson is also a director of Markey Cancer Foundation.

Mr. Jackson has founded and managed businesses and is an experienced entrepreneur and manager. In that capacity, and through his current and prior service on other public company boards, he has dealt with a wide range of issues that are important to the Firm’s business, including audit and financial reporting, risk management, and executive compensation marketing and product development. His service onsuccession planning. Mr. Jackson generally meets at least annually with the boardFirm’s principal regulators in the major jurisdictions in which we operate.

Mr. Jackson served as a director of The Home Depot from 2004 to 2008 and a director of the Federal Reserve Bank of Cleveland has given him experience dealing with government officials and agencies and further experience in financial services.

Mr. Jacksonfrom 1987 to 1992. He is a member of the Audit Committee Leadership Network, (“ACLN”), a group of audit committee chairs from some of North America’s leading companies that is committed to improving the performance of audit committees and helping to enhancestrengthening trust in the financial markets. He is also an emeritus Trustee of the Markey Cancer Foundation.

Mr. Jackson’s service on the board of the Federal Reserve Bank of Cleveland and on other public and private company boards has given him experience in financial services, audit, government relations and regulatory issues.

Mr. Jackson is a graduate of the United States Military Academy.

|

| |

14 • JPMORGAN CHASE & CO. • 2015 PROXY STATEMENT |

Michael A. Neal, 62

|

| | |

| | Director since 2014 Risk Policy Committee Retired Vice Chairman of General Electric Company and Retired Chairman and Chief Executive Officer of GE Capital |

|

| | | |

| DIRECTOR QUALIFICATION HIGHLIGHTS |

| • | | Extensive background in financial services |

| • | | Leadership of large, complex, international businesses in a regulated industry |

| • | | Risk management and operations experience |

Michael A. Neal was Vice Chairman of General Electric Company, a global industrial and financial services company, until his retirement in December 2013 and was Chairman and Chief Executive Officer of GE Capital from 2007 until June 2013. During his career at General Electric, Mr. Neal held several senior operating positions, including President and Chief Operating Officer of GE Capital and Chief Executive Officer of GE Commercial Finance prior to being appointed Chairman and Chief Executive Officer of GE Capital.

Mr. Neal has extensive experience managing large, complex businesses in regulated industries around the world. During his career with General Electric and GE Capital, Mr. Neal oversaw the provision of financial services and products to consumers and businesses of all sizes in North America, South America, Europe, Australia and Asia. His professional experience has provided him with insight and expertise in risk management, strategic planning and operations, finance and financial reporting, government and regulatory relations, and management development and succession planning.

Mr. Neal graduated from the Georgia Institute of Technology. He serves on the advisory boards of Georgia Tech’s Sam Nunn School of International Affairs, and the Carey Business School at Johns Hopkins, where Mr. Neal is also the executive in residence and senior advisor to the Dean. Mr. Neal is also a trustee of Georgia Tech’s GT Foundation.

Lee R. Raymond, 76 (Lead Independent Director)

|

| | |

| | | | |

Lee R. Raymond, 74 |

Retired Chairman and Chief Executive Officer of Exxon Mobil Corporation, oil and gas |

Director since 2001 and Director of J.P. Morgan & Co. Incorporated from 1987 to 2000 Compensation & Management Development Committee (Chair)

Corporate Governance & Nominating Committee Retired Chairman and Chief Executive Officer of Exxon Mobil Corporation |

|

| | | |

| DIRECTOR QUALIFICATION HIGHLIGHTS |

| | • | | Extensive background in public company governance and international business |

| | • | | Leadership in regulated industries and regulatory issues |

| • | | Management development, compensation and succession planning experience |

Mr.Lee R. Raymond was Chairman of the Board and Chief Executive Officer of ExxonMobil, the world’s largest publicly traded international oil and gas company, from 1999 until he retired in December 2005. ExxonMobil’s principal business is energy, involving exploration for and production of crude oil and natural gas, manufacture of petroleum and petrochemical products, and transportation and sale of crude oil, natural gas, petroleum and petrochemical products. He had beenwas Chairman of the Board and Chief Executive Officer of Exxon Corporation from 1993 until its merger with Mobil Oil Corporation in 1999 having begun his career in 1963 with Exxon. Heand was a director of Exxon and Exxon Mobil Corporation (1984–2005).

from 1984 to 2005. Mr. Raymond graduated from the University of Wisconsinbegan his career in 1960 and received a Ph.D. from the University of Minnesota in Chemical Engineering in 1963. He is a director of the Business Council for International Understanding, a Trustee of the Wisconsin Alumni Research Foundation, a Trustee of the Mayo Clinic, a member of the Innovations in Medicine Leadership Council of UT Southwestern Medical Center, a member of the National Academy of Engineering and a member and past Chairman of the National Petroleum Council.1963 at Exxon.

During his long tenure at Exxon MobilExxonMobil and its predecessors, Mr. Raymond gained important experience in all aspects of business management, including audit and financial reporting, risk management, executive compensation, marketing, and operating in a regulated industry. He also has extensive international business experience.

Mr. Raymond is a member of the Council on Foreign Relations, an emeritus Trustee of the Mayo Clinic, a member of the National Academy of Engineering and a member and past Chairman of the National Petroleum Council.

Mr. Raymond graduated from the University of Wisconsin and received a Ph.D. in Chemical Engineering from the University of Minnesota.

|

| |

6 | JPMorgan ChaseJPMORGAN CHASE & Co./ 2013 Proxy StatementCO. • 2015 PROXY STATEMENT • 15 |

William C. Weldon, 66

|

| | |

| | Director since 2005 Compensation & Management Development Committee

Corporate Governance & Nominating Committee (Chair) Retired Chairman and Chief Executive Officer of Johnson & Johnson |

|

| | | | |

| | | | |

William C. Weldon, 64 |

Retired Chairman and Chief Executive Officer of Johnson & Johnson, health care products |

Director since 2005DIRECTOR QUALIFICATION HIGHLIGHTS |

| | • | | Extensive background in public company governance and international business |

| | • | | Leadership of complex, global organization in a regulated industry |

| • | | Management development, compensation and succession planning experience |

Mr.William C. Weldon was Chairman and Chief Executive Officer of Johnson & Johnson, a global healthcare products company, from 2002. He retired2002 until his retirement as Chief Executive Officer in April 2012 and as Chairman in December 2012. He served as Vice Chairman from 2001 and Worldwide Chairman, Pharmaceuticals Group from 1998 until 2001.

At Johnson & Johnson, is engaged worldwideMr. Weldon held a succession of executive positions that gave him expertise in the researchconsumer sales and development, manufacturemarketing, international business operations, financial reporting and sale of a broad range of products in the health care field. The company conducts business in virtually all countries of the world with the primary focus on products related to human health and well-being.regulatory matters.